In the yesterday’s SNB LIBOR rate announcement, the central bank has maintained status quo, leaving interest rates unchanged at -0.75% followed by monetary policy assessment and press conference.

In the press conference, Thomas Jordan stated that “we are maintaining our expansionary monetary policy, with the aim of stabilizing price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between – 1.25% and – 0.25%. We will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The negative interest rate and our willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency. The Swiss franc is still significantly overvalued.”

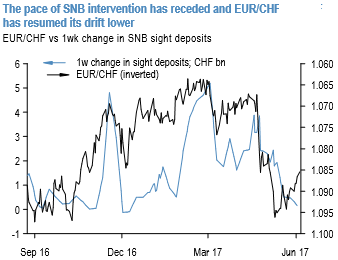

The bounce in EURCHF following the French election has started to slowly fade as the SNB has scaled back its FX interventions, although admittedly this has come with a lag. SNB interventions had picked up to a weekly pace of CHF 2.4bn in April in the lead up to the French elections as EURCHF approached 1.0675.

Quizzically, SNB didn’t show a material slowing in the pace of interventions in the two weeks following the first round of elections with the weekly intervention averaging CHF 1.8bn in the first half of May even though EURCHF had retraced its move higher to near 1.09 over this period. This led to some concern that the SNB may have adopted a more aggressive intervention approach contrary to previous episodes of political stress such as the Brexit vote and the US election which were met with aggressive intervention during the events but in both cases, the SNB stood aside once the political threat abated. We had expected a similar moderation this time around and this has finally materialized with the latest sight deposit activity implying virtually no intervention activity in the past week (refer above chart).

The forecast remains moderately bullish on CHF. The forecast for EURCHF is to trend lower over the coming year on a combination of Switzerland's favorable balance of payments dynamics and a gradual scaling back of SNB interventions to 1.05 by the end of the year and maintain a 1.04-1.05 range in 1H18.

EURCHF 1m bearish-neutral risk reversals and shrinking IVs signal writers’ opportunity in option strangle in range bounded trend.

As a result, we recommend below option strategies using right strikes, thereby, one can benefit from certain returns.

Short 2m OTM put (2% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (2% strike referring upper cap) (we reiterate, comparatively short term for maturity is desired).

Overview: Slightly bearish in short term but sideways in the medium term.

When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures