It does come as a surprise that - contrary to other risk events such as the Brexit referendum etc. - the SNB does not create a buffer of CHF weakness which would prevent the franc from appreciating excessively in the case of a risk-off event (in this case: a Donald Trump election victory).

EURCHF trading just above 1.08 does not really constitute “CHF weakness” in my view. Does the SNB expect a Clinton victory with such certainty? That would be careless. However, the alternative explanation is even more worrying: that it is tired of interventions.

OTC updates:

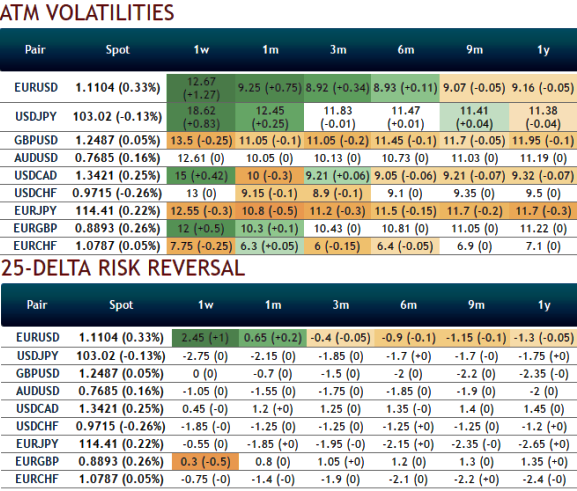

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have been the least among G10 currency segment.

While the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

Option-trade recommendations:

We could still foresee range bounded trend to persist in near future but little weakness on weekly charts is puzzling this pair to drag southward targets but very much within above stated range.

As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

How to execute iron butterfly spread:

At current spot at 1.0785, one can prefer this strategy on the same lower IV circumstances. To execute the strategy, the options trader buys a lower strike OTM put, sells a middle strike ATM put, sells a middle strike at-the-money call and buys another higher strike OTM call. This results in a net credit to put on the trade.

Overview: Slightly bearish in short term but sideways in the medium term.

Time frame: 7 to 10 days

Volatility expectation: Low volatility.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One