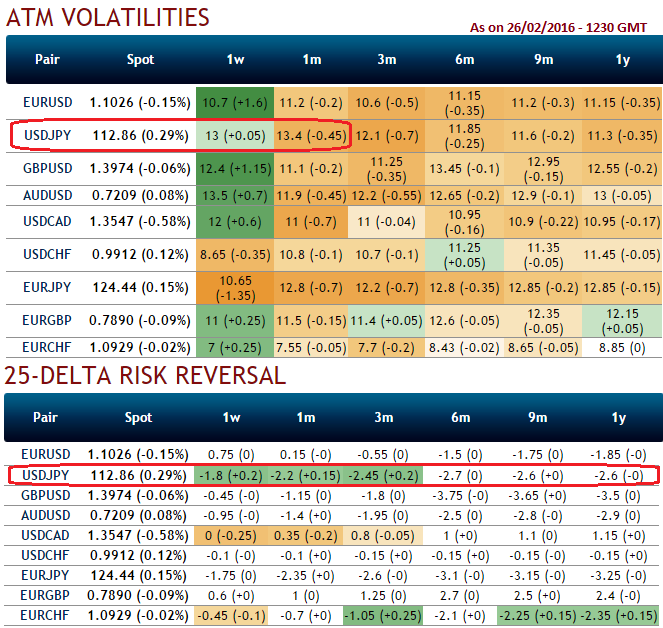

Please be noted on delta risk reversals' indication as to how the OTC markets are positioned for hedging downside risks, and sentiments are getting higher negative values gradually in a long run as well (flashing at -2.6 for 1 year expiries).

While ATM volatilities implied in these OTC market positions are flashing 13 to 13.5% for 1w to 1m expiries which is the highest among G10 currency segment.

Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

We give heads up now is to determine which strikes you should accurately use in the strategy that is effectively hedge these downside risks. The broader the strike difference between short and long puts, the fewer puts you need to sell to cover the price of the long puts. But at the same time, the coverage of long-to-short is going to be more difficult in the event of assignment.

The current spot FX is trading at 112.974, as we expect more dips extending up to 110 levels in the weeks to come, aggressive bears can initiate strategy using ATM puts. It is understood that these instrument are likely to expire in the money as the bearish momentum is bolstering as we saw that from delta risk reversal table and technical indications.

On the other hand, unlike a simple naked put, put back spreads have an extra long that has not only leveraging effects, a short option at a lower strike that caps your reward but also reduces the net cost of the trade. So, the recommendation for now is to add an extra long on put with 1W expiry to the existing debit put spreads.

So, the strategy goes this way, go long in 1M at the money -0.49 delta put, long in 2M (1.5%) out of the money -0.31 delta put and 1W (1%) in the money put option with positive theta.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying. It makes this strategy a good one if the skew is running a little hot but USDJPY hasn't rolled over that much.

FxWirePro: Risk reversals signs USD/JPY bearish rout to prolong further - Put ratio back spreads to tackle both weakness and higher IVs

Monday, February 29, 2016 8:49 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?