We have been bearish NZDUSD, owing to idiosyncratic growth challenges, and a dovish central bank. The RBNZ’s priorities are quite clear. They want a weaker exchange rate and have greater than average risk tolerance in getting it.

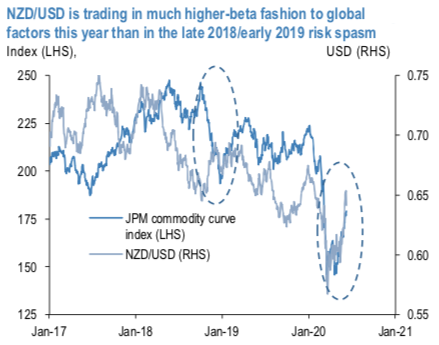

Mid-May’s burst of RBNZ dovishness was followed by a pretty much uninterrupted 8% rally in NZDUSD. In reality though, this bullish turn is less of a direct challenge to the RBNZ’s rhetoric than it is maintenance of the very high correlation to global risk markets that

NZD has demonstrated all year (refer above chart).

The medium-term perspectives: Risk sentiment is expected to remain firm into year-end, supported by unprecedented global central bank and government stimulus. In addition, NZ’s economic rebound has been slightly stronger than previously expected. All that should help NZDUSD end the year at around 0.65 levels. In the interim, there remains potential for a pullback to 0.61 on bouts of risk aversion, for example if the recent phase of positive NZ data surprises flips to data disappointments.

OTC Updates and Hedging Strategies:

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing moderated IVs among G10 FX bloc (3m IVs are in between 10.04 – 11.67%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

The skewness of 3m IVs still signals extreme downside risks, bids for OTM put strikes are quite visible (up to 0.6250 for these tenors, refer 2nd chart). Based on above-mentioned fundamental factors and OTC outlook, diagonal debit put spreads are advocated, the strategy is designed to mitigate the downside risks with a reduced cost of trading.

The execution: Short 1m (1.5%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options capitalizing on the minor upswings in the short-run.

Alternatively, we recommend short hedges staying shorts in NZDUSD futures contracts of July’20 delivery with a view of arresting bearish risks in the major trend. Courtesy: Sentry & JPM

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure