Federal Reserve’s monetary policy announcement provides the focus for today. Given the FOMC raised the Fed funds rate to 2% (upper bound) in June,

Ahead of Fed, there have been signs for further weakness in the precious metal space. Safe haven demand has not flowed into Gold and its precious metal cousins; market-watchers seem to prefer the greenback and US assets instead, with the DXY rising beyond its 95.0 handle of late. Physical and paper gold demand remained weak, while higher US interest rates into 2018 could cap gold’s rally.

Well, on the back of depressed vols in bullion markets (especially gold) and x-vol levels and amid the escalation in trade uncertainty we recommended a defensive long gold/AUD ATM vs short AUDUSD puts (both legs delta-hedged) as an RV-friendly expression of outright XAUUSD vol.

With the lingering sentiments of trade frictions swiftly turning more positive following the Trump Juncker’s deal on Wednesday that marks a new chapter in US-EU trade, we are inclined to fade the recent rally in gold front tenor vols.

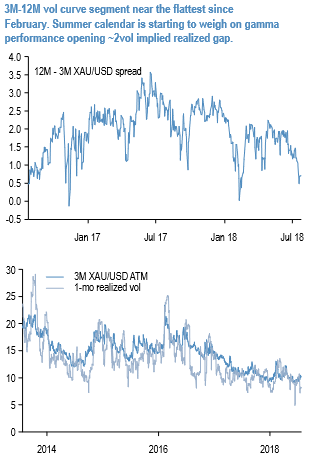

Following the July bounce, 3M implied vol is 1vol from the YTD low and full 2pts above the RV. Moreover, with 1Y vol hitting multi-decade lows, at 0.7 vols 1Y-3M gold vols curve slide is near the lowest since February (refer 1st chart), and 2 sigma too narrow by historical standards (with the 1-year look back).

The precious yellow metal has found itself at the mercy of the broad dollar price action as the correlation between the two strengthened since mid-2017 (refer 2nd chart) and is expected to persist. Post the 6+% rally during 2Q, the USD index started losing steam as US cyclical exceptionalism has faded and as positioning returned materially long dollar again.

FX analysts expect the broad dollar to remain within a narrow range over next four quarters. Range-bound dollar price action should keep gold prices within a tight range and consequently put a lid on gold realized vol, as per our prior analysis that established gold vol beta to gold price action at about 0.3-0.4. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index has turned -58 levels (which is bearish), while articulating (at 12:04 GMT). For more details on the index, please refer below weblink:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025