USDJPY had remained in a narrow range (2% from mid-109 to mid-111) until early this week as both USD and JPY moved together. USDJPY this week extended its bullish traction to 112-handle and reached the highest level since early January alongside the USD broad strength.

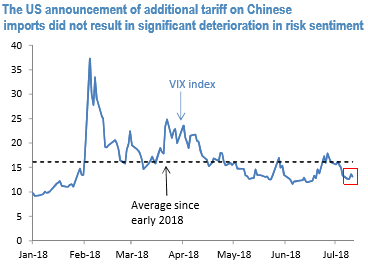

This week, the pair’s rally despite the US-China trade turmoil deterioration was somewhat baffling; however, it likely reflects market optimism about the situation. It is consistent with that the US announcement of additional tariffs on $200bn worth of Chinese imports did not trigger the VIX spike (refer above chart). In coming weeks, whether the markets can keep up with the optimism would be important for JPY.

Assuming they can, we remain comfortable with our view that USDJPY should trend moderately lower in 2H this year with both USD weakness and lingering risk factors mentioned later, but the moves would not be material and the pair would continue to trade in range.

Looking back, USDJPY remained in a relatively narrow range throughout 1H of this year.

OTC outlook: The implied volatility of ATM contracts of USDJPY is trading back towards 7.01% and 7.66% for 2w/2m tenors respectively, as the positively skewed IVs of 3m tenors signify the hedging sentiments for the further downside risks over the period of time, this appears to be conducive for put option holders. On the flip side, a positive shift is observed in the negative risk reversal (RRs) numbers, and negative RRs indicate the hedging sentiments for the bearish risks appears to be intact. While it is wise to utilize abrupt rallies amid lower vols in the below-stated options strategy.

The trend of the underlying pair (USDJPY): The above fundamental and OTC aspects are in line with the technical trend of this pair. On intermediate trend, bulls are retracing from the March 2018 bottom of 104.629 levels to the November 2017 highs, although we foresee further upside traction upto next 61.8% Fibonacci levels, abrupt bears can disrupt rallies at that juncture (refer weekly plotting). Price action on this timeframe has bounced back into the long lasting range bounded trend. For more reading on intricacies of technicals this pair, refer below web-link:

Options Trades Tips:

On a trading perspective, capitalizing on lower implied volatility environment and long lasting range-bounded trend, one can execute options strangle short strategy by writing 2w ATM calls and ATM puts of similar tenors at net credit.

On hedging grounds, while the risk-averse traders but who are slightly more dubious about downside move, accordingly, initiate longs in USDJPY 2M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, shorting 2w (1%) out of the money calls. Thereby, we favor bears as we foresee more downside risks.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 101 levels (which is bullish), while JPY is flashing at 57 (bullish) while articulating at (09:13 GMT). For more details on the index, please refer below weblink:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure