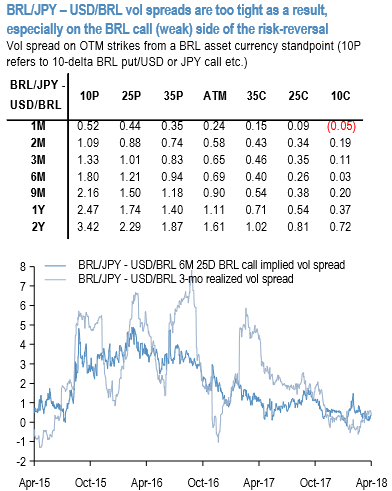

We have been carrying a long BRLJPY vs short USDBRL6M vol spread for a couple of months now with admittedly not much P/L to show for it despite timing entry just before the VIX shock; nonetheless, we believe this vol spread is the most parsimonious, transaction cost-effective expression of selling USDJPY vs USDBRL correlation and is a position we continue to like holding since technicals are still just as attractive as when we first recommended it.

The 1st chart shows that the implied vol spread at present is low both historically and compared to the general behavior of realized vols in less orderly FX markets. This is the case almost irrespective of strikes on the two surfaces, though, for choice, we have a slight preference for OTM BRL call strikes (i.e. the weak side of the risk-reversal for both pairs) where the vol differential is marginally tighter; for instance the vol differential for 6M 25D BRL call strikes is marked at 0.15 vol (mid) in 2nd chart.

For active/intra-day delta-hedgers, 1M ATMs should also be of interest where the vol spread is marked below zero, and where recent realized vol outperformance has been in excess of 2 vols (1-wk 2.2, 4-wk 2.5 based on hourly NDF samples).

Selling high-beta/EMFX vs JPY correlations from such near-zero levels is a convex trade in our view, since the fundamentally opposite risk polarities of the two currencies in question – one of which is a well-owned asset currency and the other a classic funding one – ensure that decorrelation is the norm rather than the exception for them irrespective of the state of the broad risk cycle, and violently so in a market crash; if so, the higher beta cross yen vol should always trade at a healthy premium to the low-beta USD vol, much like USD/EM risk-reversals persistently price at a premium for USD calls over USD puts to reflect the left tail risk of disruptively positive spot vol correlation.

That it is not the case at present is due to somewhat price-insensitive retail investor selling of BRLJPY vol for yield enhancement, and is an opportunity for more value-sensitive investors to pick up an easy-to-carry risk hedge on the cheap. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?