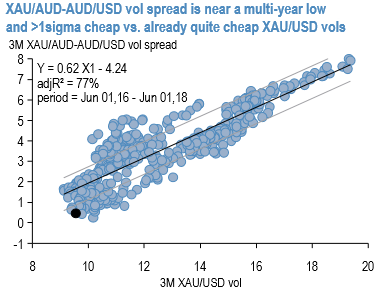

An exciting defensive RV options structure is long Gold/AUD ATM vs. short AUD/USD puts (both legs delta-hedge set-up). At multi-year lows, an artifact of uber-depressed Gold vols, the XAU/AUD-AUD/USD vol spread can be considered to be an RV-friendly expression of outright XAU/USD vol (refer 1st chart), which by all accounts is quite cheap in its own right.

While the 3 cent fall in Apr-May brought the AUDUSD back to well within short-term fair value ranges. Yield differentials along the curve continue to move steadily in the US dollar’s favor, but Australia's commodity basket has recovered some of March's steep losses, with demand for industrials resilient. US-driven trade tensions have eased and equity volatility has edged lower since early April. We look for 0.76 end-Jun, 0.75 end-Sep.

The US 10yr treasury yield rebounded from 2.89% to 2.95%, while 2yr yields rebounded from 2.46% to 2.50%. Fed fund futures were little changed and continued to predict a rate hike on 13 June and another by year end.

As we have flagged on a number of occasions and as many vol investors are well aware, owning AUDUSD skews (delta-hedged) has been one of the most reliable money losers in the post-GFC years since the reduction of RBA cash rates to all-time lows has decimated the erstwhile speculative carry positioning base in the currency and rendered it a pale shadow of its former high-beta self, with the result that the much more modest (inverse) spot-vol correlation these days during market disruptions no longer justifies a hefty premium for AUD puts over AUD calls.

Thanks to XAUAUD much higher risk beta, the vol spread has a reliable track record of widening in stress and delivering solid returns (refer 2nd chart – with shaded areas representing global high vol episodes), and at current levels carries little (0.3 vols) vol penalty for being long.

Moreover, XAU/AUD via USD implied correl is near the historical highs and XAU/AUD - AUDUSD vol spread is selling those rich correlations. We recommend defensive RV in form of buying 2M XAU/AUD ATM @7.9/8.6vol vs. selling AUDUSD @ 8.2 vol indic 25 delta puts, in vega neutral notionals.

A directional twist to the above vol spread that also utilizes the RV advantage can be structured as long XAU/AUD calls vs. short AUD puts/USD calls, a lower cost expression of long XAU/USD calls. Notably, the spread has a track record of delivering better P/Ls than outright XAU/USD calls (refer 3rd chart) at a fraction of the cost (refer 4th chart). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes