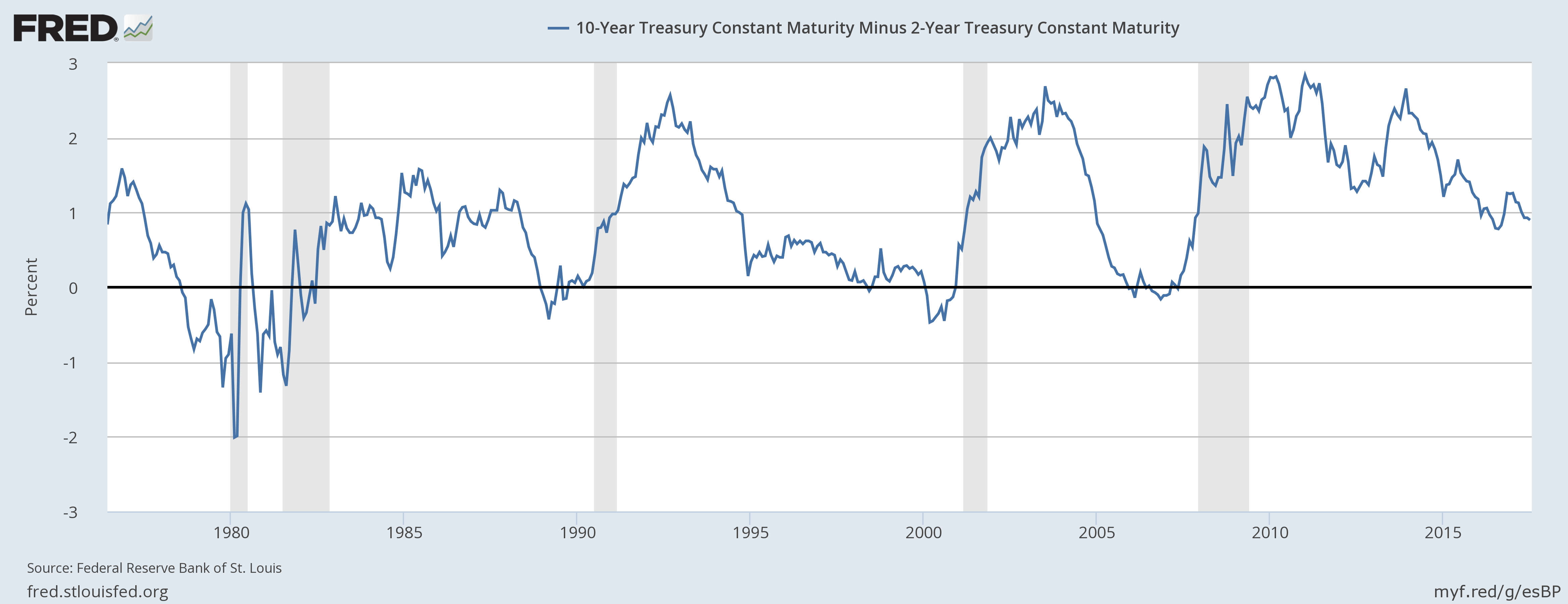

There are many indicators like PMI reports, jobs reports, inflation, industrial output, business sales etc. that we take a look into in determining whether the US economy is slowing down and heading for a recession but there is one indicator we are not losing sight of which is widely considered as the most reliable predictor of a recession and that is the yield difference between a 10-year U.S. treasury bonds and a 2-year treasury bonds.

This chart from the St. Louis Fed’s economic dashboard shows that the spread has correctly predicted last five recession. Every time before the US economy suffered a recession, the spread dipped below zero. After dipping to just 78 basis points in last August, the spread jumped to as high as 1.26 on the back of the election of Donald Trump. But as the optimism fades over President Trump’s economic agenda, the spread has taken a dive lower. It is currently at 90 basis points.

Despite the downturn, a journey towards zero is likely to be a long process and the possibility of an immediate recession in the United States remains a far-fetched idea.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed