- The Reserve Bank of New Zealand left the OCR unchanged at 1.75%.

- The bottom line guidance paragraph was the same as has been used, more or less unchanged, since February this year: "Monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly."

- The OCR forecast was the tiniest touch higher than in the August MPS forecast. Whereas previously the OCR forecast was completely flat until September 2019, it is now flat until only June 2019. However, the rate of increase over 2019 and 2020 is still very slow.

- The RBNZ acknowledged that underlying inflation is currently low, but it expects strong GDP growth will see inflation settle at 2%.

- The RBNZ published two alternative scenarios, one with a higher OCR and one with a lower OCR.

- Overall this was another neutral Monetary Policy Statement, although if anything the skew was a tiny touch in the direction of earlier OCR hikes. The RBNZ still expects the OCR to remain on hold longer than financial markets expects.

OTC Outlook and hedging strategies:

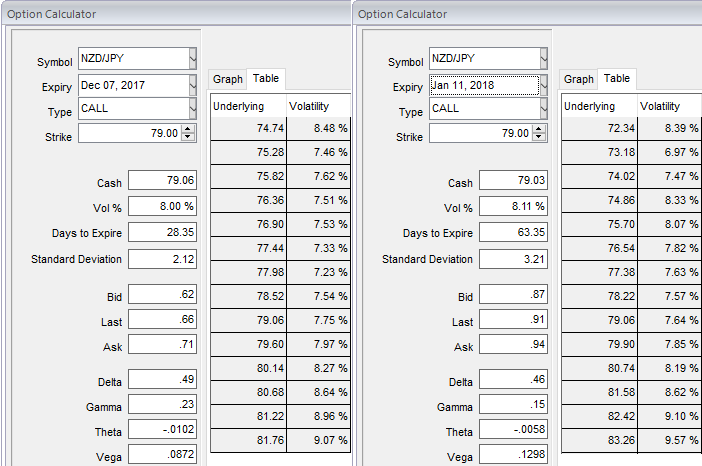

ATM IVs of NZDJPY is trading between 8% and 8.11% for 1 and 2m tenors respectively.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Thus, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 2M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.40.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Aggressive bears can bid NZDJPY 1m IVs & RR to buy 75 NZDJPY OTM put of near-month tenors.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 83 levels (which is bullish), while hourly JPY spot index was at shy above 137 (bullish) while articulating (at 06:43 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

http://www.fxwirepro.com/invest

Courtesy: Westpac

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty