Sometimes you have to repeat something again and again for it to be understood. This is what the Reserve Bank of Australia (RBA) is experiencing at the moment. Since August, the RBA has taken an aggressive verbal stance against the high level of the AUD. At its monetary policy meeting today, the RBA left its policy rate unchanged (at 1.50%) and reiterated that an appreciating AUD would be expected to dampen the RBA’s outlook.

Although all of this was in line with expectations, AUD weakened in the aftermath of the decision. As AUD has depreciated by nearly 3% against the USD since the US Fed’s September meeting, some market participants might have expected the RBA to tone down its rhetoric against AUD strength.

But clearly, that was an overly optimistic expectation given that AUDUSD is still trading close to the highest levels in nearly three years. The AUD appreciation of July isn’t even fully taken into consideration in RBA’s forecasts yet. A first estimate of the impact of the stronger AUD has to wait at least until November when the RBA publishes its next Statement on Monetary Policy. And before that, the RBA won’t change its stance with respect to the AUD which should limit renewed AUD gains.

AUD had required the RBA to talk up the economy locally to spur confidence, while talking it down internationally, to ease market pressure on financial conditions.

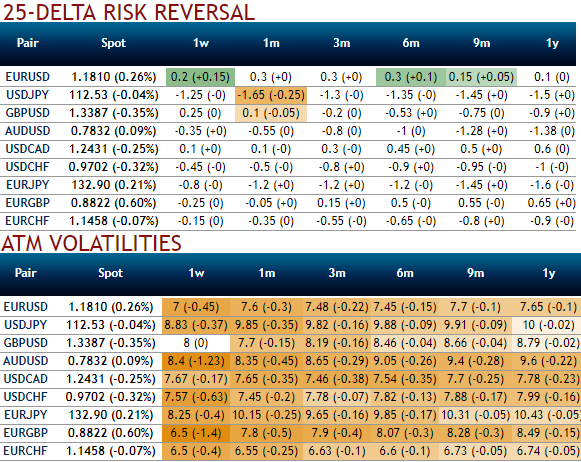

Please be noted that IVs are shrinking away with the positively skewed IVs of 3m tenors signifying the hedgers’ interests to bid OTM put strikes upto 0.76 levels (refer above diagram). While 1w negative risk reversals indicate rising hedging sentiments for bearish risks, bearish neutral delta risk reversal divulges the interests in hedging activities for downside risks remains intact amid mild upswings.

Well, the bearish stance has been substantiated by AUDUSD's rising IV in 1-3m which is an opportunity for put longs in long-term and using shrinking IVs of shorter tenors with bearish neutral delta risk reversal can be interpreted as an opportunity for writing OTM puts or theta shorts in short run on time decay advantage as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics