We think that the RBA board will take a break, albeit a much longer one than the FOMC. The next meeting after the RBA's meeting next week will not take place until February.

The capex (private investment) for Q3 published yesterday at -9.2% Q/Q as bad as never before, confirms that the restructuring of the economy away from the commodity sector towards other sectors of the economy is progressing only slowly.

That means Stevens cannot yet abandon his expansionary monetary policy.

Hedging Frameworks:

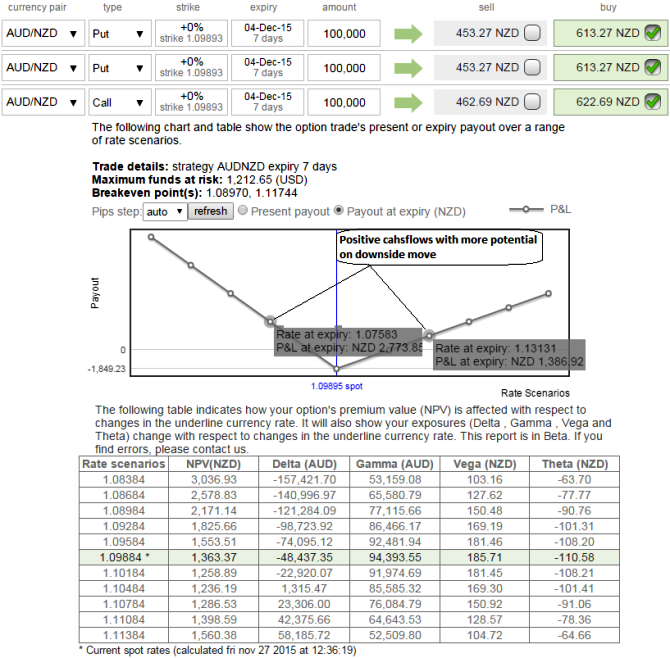

As we are bearish on this APAC currency cross, IVs have also been highly aggressive, we would like to be benefitted from downside momentum by implementing this strips strategy.

By buying two ATM Put Options & one ATM Call Option, of the same strike price, expiry date would hedge the both abrupt rallies and anticipated dips.

Risk reward profile:

Risk is mitigated and limited to the extent of premium paid (NZD 1849.23) to the option writers.

Reward is unlimited until the expiry of the option (Payoff functions are expressed in the diagram).

Please be noted that one can still mint money even if prediction goes wrong - but the price should spike in the adverse trend swiftly (i.e. ATM call bought that we buy has to beat the cost of buying all the options and still bring in some profits).

BEP levels on adverse side - 1.1176 and above.

The strategy has a delta of 0.48 which means if the underlying pair moves up 1 pip then price of the ATM option will go up by 0.48.

FxWirePro: RBA defers monetary interventions on sluggish capex, -0.48 delta strips of AUD/NZD for hedging

Friday, November 27, 2015 7:19 AM UTC

Editor's Picks

- Market Data

Most Popular