The strategy for trading EMFX encompasses a mixed bag. It is generally pro-risk through exposure to high yielders but with a modest long dollar bias by shorting low yielders that offer little value either from a carry or fundamental perspective (complete list of trade ideas in Trade Monitor). This balanced approach remains prudent.

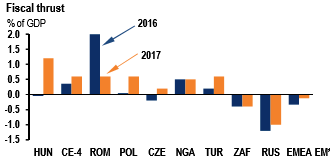

In 2017 we expect fiscal policy stances to diverge across the region; Turkey and CE-4 and should expand stimulus while South Africa, Russia, and MENA pursue tighter fiscal policy. The fiscal thrust in the EMEA EM region would be largely neutral this year; this still holds, but the country composition has changed. We now expect a looser stance in Turkey and tighter one in Russia with the consolidation effect from Russia dominating (Refer above diagram).

Risk on price action in EM FX overnight; for now (and absent a catalyst), it is hard to fight the trend especially in high yielding space. It seems like any risk premium related to Trump is evaporating and there is no longer any concern about the Fed, Chinese growth, or CNY.

Reduction in risk premium is being supported by improving fundamentals – growth dynamics improving across an EM aggregate and return on assets perking up from the mid-2016 low.

Trade recommendations:

Short SGDINR: Risks of MAS easing have decreased but no justification for SGD NEER to stay above the midpoint. Carry-to-vol super attractive; initiate/add exposure with a stop around 48.20.

Short EURTRY: Offers good risk-reward at these levels based on:

The positive EM sentiment

CBRT actions (funding, swaps)

The electoral risk in Europe.

USDRUB put butterfly: Everyone loves the RUB but positioning is heavy. Put butterfly is a good way to gain RUB exposure without losing on a correction. Asymmetric strikes provide some P&L gains if RUB strengthens a lot.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge