Banxico hiked 25bp; we see limited MXN gains but prefer calendar skews at the current juncture.

Banxico has hiked its policy rate 25bp to 6.5% and signaled a shift in gears towards a slower pace of tightening ahead.

Following the policy statement, JPMorgan updates its policy call and now looks for Banxico to hike 25bp in May and keep the policy rate stable at 6.75% thereafter.

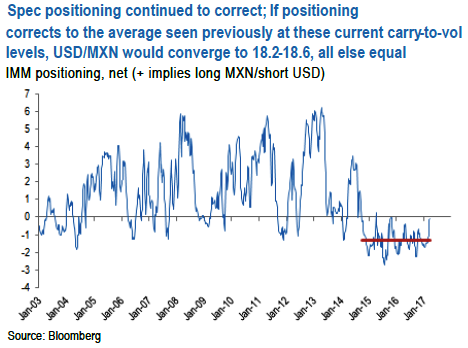

As discussed in a note published last week, attractive carry-to-volatility ratios should help the MXN in the medium term, and speculative positioning seems to have begun reacting to that– the last time carry-to-vol was at current levels, speculative positions were substantially long MXN.

If positioning corrects to the average seen previously at these current carry-to-vol levels, USDMXN would converge to 18.2-18.6, all else equal.

In all, higher Mexican rates and lower volatility make the MXN more attractive as a short-term trade, although we see limited capital gains at these levels.

Next week, the Trump-Xi meeting could cast light on US trade strategy going forward and could reverberate on USDMXN.

In the last few weeks, we have seen a material easing of the anxiety that had built around the NAFTA renegotiations.

Yet, there is no clarity yet on the US administration’s intentions for the NAFTA renegotiation, and we are still wary of the bargaining power that an existing Mexican administration will have, given Mexican Presidential elections are scheduled for June 2018.

As we see risks resurfacing in H2’17 and note that risk reversals look cheap, even when filtering out the impact of the recent ATM vol drop. Thus, we recommend buying gamma neutral calendar skews (sell 3M 25 delta put, buy 6M 25 delta call, in gamma neutral notionals).

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics