We advise initiating longs GBPUSD vs EURGBP 6m volatility swaps @ 0.3 vols; indicative offer: same GBP notional in both legs.

The vega mark-to-market is roughly proportional to the implied vol spread and its odds are even more attractive than the realized vol odds, which reflect the odds of the payoff at expiry (refer above distribution graph).

Indeed, the trade valuation will benefit from any widening of the implied spread from its almost flat level (a March hike surprise would definitely shake cable more than EURGBP).

So, we recommend unwinding the package in the event of early vega profit, especially if it happens before the French election.

The rationale:

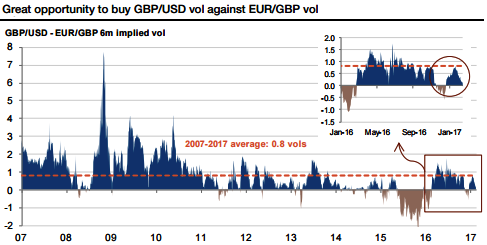

The 6m vol spread between GBPUSD and EURGBP volatilities is quasi-flat, whereas GBPUSD has been more expensive 82% of the time since 2007 (see above graph showing IVs).

The realized vol of the spread from 2m to 1y is between 1.5 and 2.5 vols (refer above graph for compared vols). GBP idiosyncratic risk canceled out. The common risk is canceled out in the two legs, provided there is a consistent weighting.

Given that both vols are very close, we obtain an almost vega-weighted trade in taking equal notionals. EUR risk short-lived. The recent tightening of the spread is essentially due to the political risk premium in Europe, which is currently supporting EUR vols.

Our central scenario sees Marine Le Pen failing to win the French presidential election and a euro bounce accompanied by a deflating of the EUR crosses volatility premium. USD vol supported by US fiscal/monetary mix.

Over the next months, US-Europe monetary divergence clearly supports a lasting volatility premium in USD crosses over EUR crosses, via more volatility in USD long rates and a Fed could become more hawkish than the market expects. This is the standard pattern seeing GBPUSD vol trading at a premium over EURGBP vol.

The headline US CPI and the announcement of the tax cut agenda at the end of the month could revive the market appetite for inflationary trades. This would support dollar volatility. Expression EUR risk prompts to pick the 6m tenor via volatility. The spread is the cheapest on the 3m and 6m tenors. 3m contracts now encompass the French presidential election.

We expect volatility disruptions ahead of the risk event to be potentially significant but short-lived. All in all, a short-lived volatile period will be more effectively diluted in selling that premium over a 6m rather than a 3m vol contract, via a larger number of fixings.

However, this is still a tail risk, so we prefer implementing the trade via volatility swaps rather than variance swaps (more painful if the unity of the euro area crumbles).

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook