- The British pound spiked across the board after upbeat UK inflation data.

- Headline consumer prices tracked by the CPI rose at an annualized 2.9% (vs. 2.8% forecasted).

- Prices excluding food and energy costs rose above expectations 2.7% over the last twelve months.

- On a monthly basis, consumer prices also rose more than initially estimated 0.6%, sharply reverting July’s 0.1% contraction.

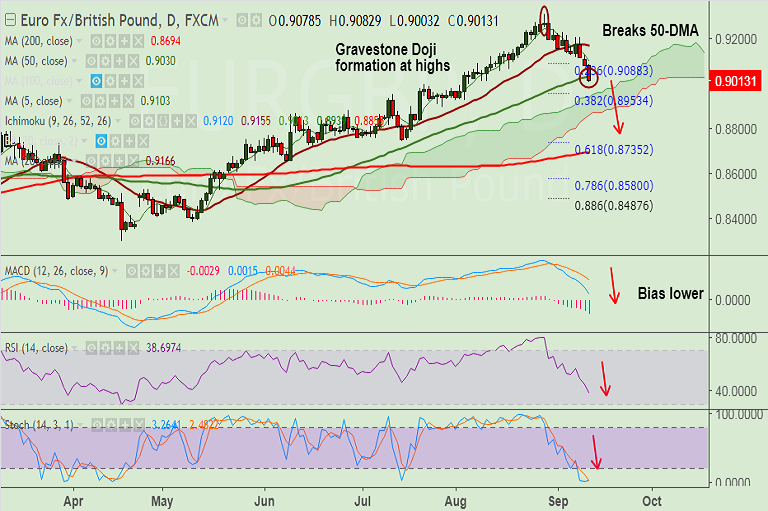

- EUR/GBP slumped to break 50-DMA at 0.9030, hit 6-week lows at 0.9003.

Call update: Our previous call (http://www.econotimes.com/FxWirePro-EUR-GBP-trades-narrow-range-below-5-DMA-eyes-50-DMA-at-09026-stay-short-892264) has hit all targets.

Recommendation: Bias lower. Book partial profits at lows. Stay short for further downside. Scope for test of 38.2% Fib at 0.8953.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest