- Aussie shows muted reaction, remains largely unchanged on RBA’s status-quo.

- RBA kept its Official Cash Rate (OCR) unchanged at a record low of 1.5%, as widely expected, at its policy meeting earlier today.

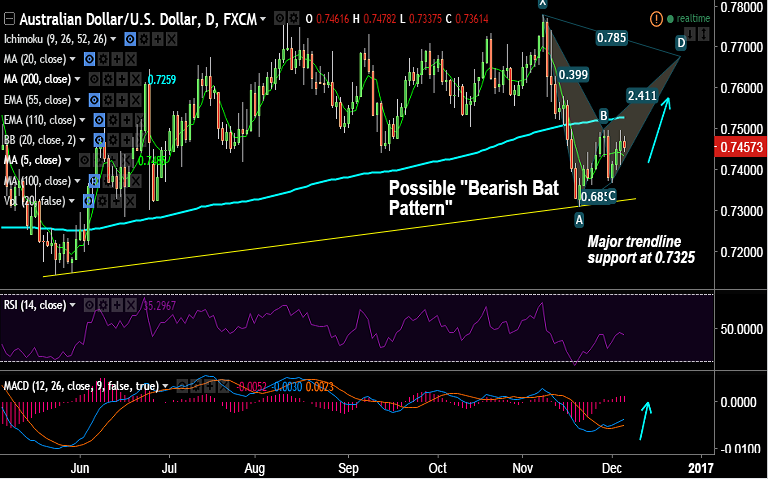

- Technically the pair is struggling to break above 0.75 barrier. Price action has edged above 5-DMA.

- We see a possible "Bearish Bat" pattern on daily charts, scope for upside on break above 20-DMA at 0.7462.

- Stochs and MACD are biased for further gains. We see weakness only on break below 0.7325 (major trendline support).

- Support levels - 0.7436 (5-DMA), 0.74, 0.7369 (Dec 1 low), 0.7325 (trendline support)

- Resistance levels - 0.7462 (20-DMA), 0.75, 0.7528 (200-DMA), 0.7536 (38.2% Fib)

Recommendation: Good to go long on dips around 0.7440/50, SL: 0.74, TP: 0.75/ 0.7525/ 0.7540

FxWirePro's Hourly AUD Spot Index was at 46.8488 (Neutral), while Hourly USD Spot Index was at -77.4707 (Bearish) at 0425 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex