EURPLN has been attempting to bounce back from the lows of 4.1988 levels in the latest trading session, however, one could make out that the trend of the underlying spot FX moves is stuck in the range between 4.2159 and 4.1945 levels.

NBP concludes a two-day council meeting and announces its rate decision today: it is widely expected that no change to monetary policy will be made.

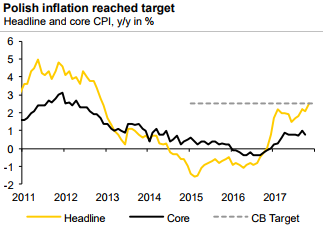

Nevertheless, this will be an interesting meeting because the central bank had been resolutely dovish in prior months, reiterating that inflation may not reach target until around 2019 – and then, we just had the inflation print for November which showed inflation hitting target already (see chart 2).

Unless this acceleration proves to be wholly driven by special factors (we will get a clearer picture when the data breakdown is published on 11 December), it would be surprising, indeed, if there were to be no change in language, no concerns within the MPC after this development.

The Polish zloty has appreciated remarkably, especially relative to peers, in anticipation that the MPC could turn more hawkish now. Given the manner in which hawks and doves are balanced at the moment – a change of view by Governor Adam Glapinski could suffice to trigger a rate hike – and this could occur during H1 2018 instead of our current base-case of H2 2018 – this is the main risk which is being priced in by the market.

We have now turned modestly constructive on the Zloty, given strong data momentum.The central bank’s dovish stance is unhelpful, but data may challenge it over coming months. Short-term valuations look cheap, demand for local bonds remains strong and the market is likely to discount political risks without any clear path for EU to impose Article 7 sanctions on Poland. We still acknowledge that PLN screens overvalued in our BEER FV framework.

Thus, we were already short in EURPLN spot, we recommend upholding below strategies:

Stay short in EURPLN spot, which is currently trading at 4.2046. The position generates carry of about +15bp per month. We target minimum 3.75% southward moves upto 4.1650, and place a stop-loss at 4.2650 levels.

Alternatively, options trading strategy has also been advocated.

At spot ref: 4.2046, we advocate entering a new EURPLN 1m2m diagonal call spread (4.1650/4.2650). The underlying spot FX trend and IVs are favorable to write ITM calls.

Rationale:

Consolidation of core rates. We believe that current valuations in PLN are attractive to establish a short EURPLN position. In our view, US and EUR rates may consolidate following the sharp re-pricing higher.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty