We predict marginal downswings on daily charts with clear converging signals from RSI (14) and stochastic curves. Although there is no trace of drastic or dramatic movements on either side we still sense some sort of upward momentum.

With upbeat PPI numbers at positive 0.2% a jump from previous -0.1% and unchanged unemployment rate at 3.2%, as there are no significant data releases scheduled until next Thursday when Swiss trade balance is likely to be announced.

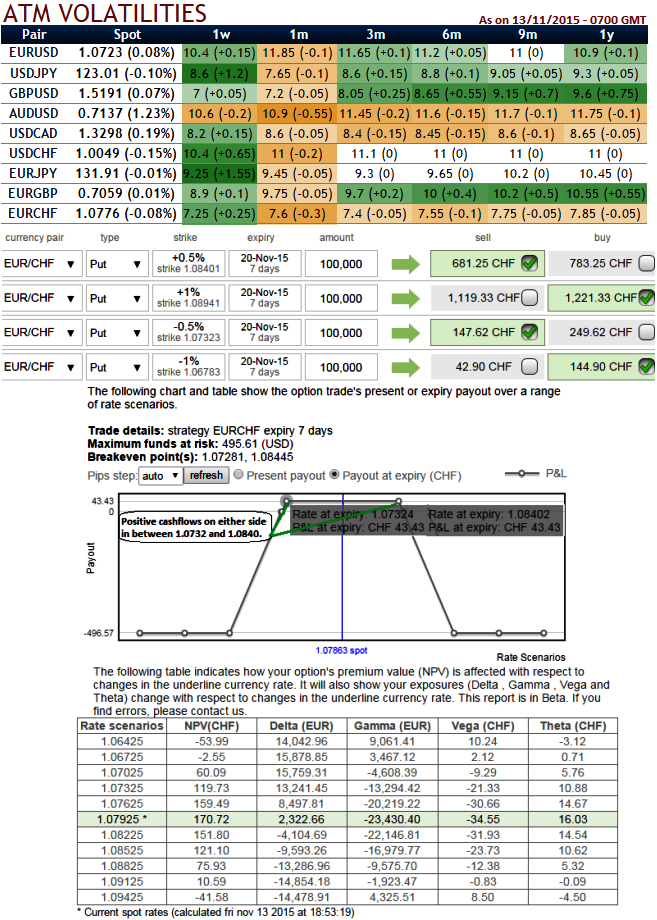

As a result in near future EURCHF is likely to experience low volatility. You can make out from the nutshell, EURCHF is to have the second least IV among G10 currency pool.

Off-late, Swiss has produced an upbeat manufacturing PMI at 50.7, while retail sales has also been improved from -0.6% to 0.2%. The healthy Swiss trade balance has printed at 3.05 billion which is a way beyond market analysts' projections at 2.51 billion and from previous flash at 2.86 billion but for October month forecasts to be remained at 3.18 billion.

Currency option strategy through Condor construction: EUR/CHF

Since the EURCHF's implied volatility is perceived to be minimal, so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

The trader can construct a long condor option spread as follows,

As shown in the figure, the trader can implement this strategy using call options with similar maturities.

So strategy goes this way, writing an In-The-Money call and buying deep striking in-the-money call, writing a higher strike OTM calls and buying another deep striking out-of-the-money call for a net debit.

FxWirePro: Place condor spreads on EUR/CHF lower IVs

Friday, November 13, 2015 1:40 PM UTC

Editor's Picks

- Market Data

Most Popular