The European Commission decided to go ahead and refer Poland to the European Court of Justice (ECJ) on alleged violation of judicial independence through its new Supreme Court act. EC warned the Polish government not to proceed with the contested law until ECJ has reviewed the challenge. There were a lot of criticism and protests in Poland, but PiS approval ratings still hold at a level which indicates victory in the next election. Hence, while interim developments may keep the risk premium elevated, it does not appear that the political fallout for PiS might be too painful. We see EURPLN rising mildly to 4.40 levels over the coming year.

The following expressions are explained of short EM and/or high- beta G10 FX vol:

OTM EURPLN calls: Our EMEA team has a constructive take on the Polish zloty, which is a first order source of comfort for vol sellers. Exposure to a slow burn recovery in the Euro area, strong domestic dataflow that has anchored growth forecasts at an impressive 3.8% pace for 2H’18 and revival of FDI inflows are FX positives that should promote PLN outperformance vis-à-vis regional EM peers.

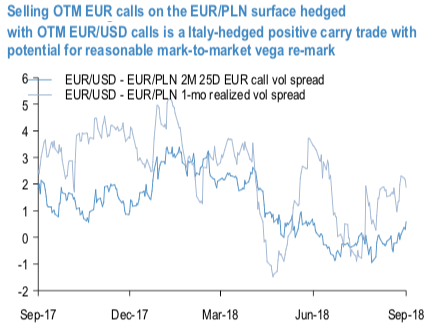

On the vol side of things, EURPLN risk-reversals have been elevated for a while (SABR implied spot-vol corr for 3M riskies 42%), but it is only in the past couple of weeks that realized spot-vol corrs have plummeted (10-day spot-3M ATM vol corr. -20%) and created genuine value in selling OTM EUR calls on the surface. This is better done in shorter rather than longer maturities given the flatness of the vol curve. For instance, 2M 25D EUR calls at 6.3 vol are priced at a 1.5 vol premium to trailing 1-mo realized vol.

We prefer taking advantage of this richness via short EURPLN – long EURUSD option spreads using OTM EUR calls.

The rationale is two-fold: (a) neutralization of Italian budget risks inherent in selling EUR-cross options; and (b) the long vol hedge is efficient on a standalone basis and does not detract from core short vol P/L: in contrast to the EURPLN surface, OTM EUR calls are priced at a discount on the EURUSD surface, and gamma is much firmer. The net result is a positive carry vol spread construct that has decent potential for mark-to-market gains from a re-pricing of implied vols (refer above chart). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 92 levels (which is bullish), while hourly USD spot index was at 38 (bullish) while articulating (at 13:25 GMT). For more details on the index, please refer below weblink:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data