The action on currency markets yesterday saw the euro remain on the back foot. Once again, weak macro data weighed on the currency. The German ZEW measure of economic sentiment dropped sharply in February. For the Aussie dollar, RBA’s monetary policy meeting is the major event which is scheduled on 3rdMarch, the rates markets are pricing a 5% chance of easing at the upcoming meeting (whole broader consensus is status quo), and a terminal rate of 0.46% (RBA cash rate currently at 0.75%). Australian 3yr government bond yields dropped from 0.72% to 0.70%, 10yr yields from 1.04% to 1.01%.

On the other hand, the euro is likely to suffer from the fact that the ECB will resume its net purchases of bonds. As stated in our recent post, EURAUD has seen a topsy-turvy swings in both minor as well as major trends, the pair has relentlessly been slipping from the peaks of 1.6594 levels to the 1.6132 levels. We have, therefore, lowered our year-end forecast for EURAUD from 1.68 to 1.6550.

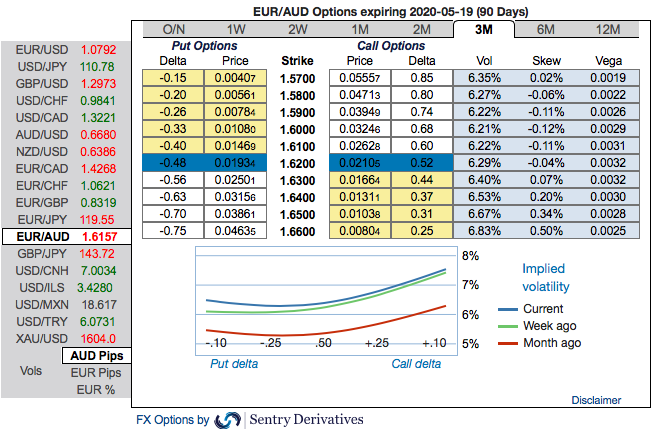

OTC Indications and Options Strategy: Please be noted that IV skews of EURAUD are stretched on either side, the positively skewed IVs of 3m tenors are signifying more hedging interests in bullish risks. More bids for OTM calls of this tenor indicate that the underlying spot FX likely to spike up to 1.66 levels.

Contemplating fundamental and OTC factors as explained above, although it is sensed that all chances of Aussie dollar looking superior over Euro in the near term and vice versa in the medium-term future; we advise to hedge the puzzling swings through below options recommendations.

The execution: Spot reference: 1.6150 levels, buy 2 lots of at the money 0.51 delta call option of 3m tenor and simultaneously, buy at the money put option of 1m tenors. The option strap is more customized version of straddles but instruments slightly biased bullish risks. Courtesy: Sentry & Tradingview

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices