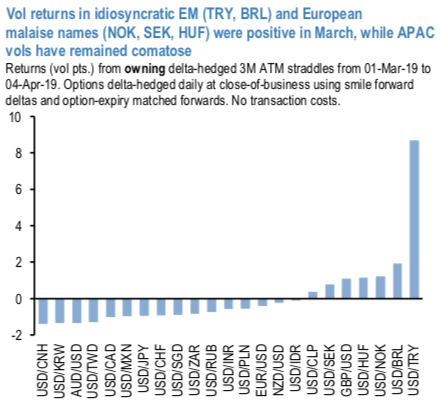

As FX option markets enter into 2Q’19, we see some signs of life in EM where idiosyncratic macro stories have begun to re-emerge (TRY, BRL) and select satellite European currencies (NOK, SEK, HUF) that are proving more responsive to persistent European growth malaise than the Euro itself (refer above chart).

The two pockets that continue to remain stubbornly comatose are G3 and Asia FX. The surfeit of liquidity in the underlying spot in the former has always been the Achilles heel for vol buyers, which perhaps explains why Euro vol ownership has proven to be a frustrating endeavor over the past two decades except for brief periods around the GFC and the European debt crisis.

NAFTA bloc vols and risk-reversals can jump, if we are correct that a standoff between the Trump administration and the Democrat-controlled House around the issue of USMCA ratification is higher odds than the market gives it credit for.

The CAD risk premia section below flags that owning EURCAD and EURMXN risk-reversals are good value hedges against a NAFTA accident.

CADCHF 6m IV skews are stretched on either side (both OTM calls and OTM puts are having equal demand), which means hedgers’ sentiments are positioned for both downsides as well as upside risks. While the same has been the case with USDCHF, both OTM calls and puts are on higher demand.

We revise MXN slightly stronger in 2Q and 3Q’19 given recent evidence that short USD positions are less likely to be unwound on fiscal concerns alone.

We add longs in MXN puts with KO = 18.5 (spot reference: 19.079 levels).

We also continue to be positioned short CAD via a long-held CAD put/CHF call vs. USD put/CHF call option spread (spot reference: 0.7550 levels).

Stay long in 6M 0.70 CADCHF put option vs short 6M 0.9450 USDCHF put at zero cost (spot reference: 1.0202 levels). Courtesy: Sentry & JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -87 levels (which is bearish), while hourly USD spot index was at 80 (bullish) and CAD is at -24 (mildly bearish) while articulating at (09:09 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch