The FX market is not alone in its concerns about weak global growth. An increasing number of central banks are warning of the resulting external risks. Yesterday Riksbank also caved in and assumed a more cautious course; even though it principally sticks to its outlook for a more restrictive monetary policy. It is still planning rate hikes and has even announced to change the reinvestment of the bonds held by the bank in such a manner that its holdings will fall slightly by the end of 2020.

However, what was mainly relevant for the market yesterday was that Riksbank lowered its rate path. EURSEK levels of above 10.60 show clearly that the FX market doubts whether Riksbank will be able to decouple from the developments in the eurozone.

While the outlook for the eurozone remains subdued SEK traders clearly do not expect Riksbank to aggressively hike interest rates to support SEK. There doesn’t seem to be another explanation to why krona is trading at the current weak levels despite Riksbank’s principally more restrictive approach.

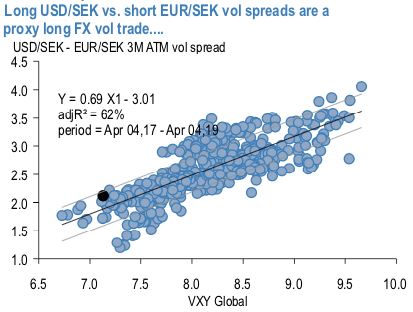

Long USDSEK vs short EURSEK vol spreads is a carry friendly way of owning FX vol from multi-year lows. Owning USD vol over cross-vol has almost always acted as a proxy bullish vol stance owning to the greater risk beta of the USD leg, and USDSEK vs EURSEK is no exception (refer 1stchart). Case in point, the ~2 vol trough-to- peak vol spike in the VXY index during the EM sell-off of Q2-Q3 last year was accompanied by a near-identical move in the USDSEK – EURSEK 3M vol switch. By construction, the spread is more or less immune to idiosyncratic SEK dynamics (if anything, a tad positively geared to krona noise owing once again to USDSEK’s greater beta). The additional appeal is that unlike in most individual currency pairs, implied vs. realized vol technicals are favourable for sustaining the position without stopping out on the decay bill (refer 2ndchart).

Comfortingly, USDSEK also screens as a strong conviction vol buy on our machine learning-based (SVM) gamma trading model (see above nutshell), hence downside to vol ownership there should be limited.

For those averse to any kind of vol ownership in the current climate, it may still be worth considering the short EURSEK leg of the RV above in limited risk format.

The preference is for a 2M 10.30 – 10.65 at-expiry digital EURSEK range (seller of the range collects 44% EUR from selling a 2M 10.30 EURSEK digital put and a 2M 10.65 digital EURSEK call) that eliminates the jump risk of American barriers (DNTs) even if it comes at the cost of markedly reduced leverage (1:2.3 instead of say 5:1).

The macro analysts see EURSEK nearly flat through 2Q (10.40) and only modestly lower around 10.30 in 6-mo time, the lack of excitement in the spot is probably attributable to a slow-moving Riksbank. The range extremes in our preferred structure are skewed to the upside in the spot in deference to the deep malaise in Euro area growth that can potentially extend EURUSD weakness to or below 1.10 in coming months; such Euro weakness has historically been associated with a rise in EURSEK. Courtesy: JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR is at -86 (bearish), hourly USD spot index was at 35 (mildly bullish) while articulating (at 14:11 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge