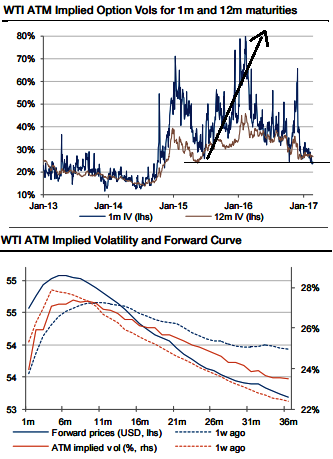

Crude oil implied volatilities (IVs) have been lingering under downward pressure, especially in short tenors. The WTI 1m ATM IVs have shrunk to about 23.8% which is the lowest level since October 2014 which was before the November 2014 OPEC meeting where OPEC decided against cutting production and instead let market prices adjust lower to balance the market.

The implied volatilities of longer-dated crude oil option maturities remain elevated compared to where they were trading prior to the November 2014 OPEC meeting. For example, the WTI 12-month ATM implied volatility is currently trading at about 26.8% while it was trading below 20% during the January-October 2014 period.

The overall shapes of the WTI and Brent crude oil ATM implied vol forward curves are broadly similar to their forward oil price curves, i.e. implied vols increase with maturity out to about the 6-month maturity followed by a gradual decline in implied vols for longer maturities. We expect the shapes of both the crude oil implied vol and price forward curves to flatten from the short-end over coming months with a possible move into full, or nearly full, backwardation as early as Q3 this year.

The latest oil demand-supply forecasts which are predicting substantial global oil stockdraws. The extremely high OPEC output cut compliance combined with strong global demand growth are expected to result in significant large OECD stockdraws starting already in Q1 followed by stockdraws in every quarter this year.

If OECD stock levels do approach the 5-year average, the short end of the forward price curve is likely to have the most upside potential because without high stock levels there is little preventing prices from going higher while longer-dated prices are likely to be capped by producer hedging.

In other words, perhaps it is a good time to consider bullish oil option strategies ahead of the expected large OECD stockdraws.

The above charts show optimized bullish WTI call option strategies for 3-month maturities. The charts make it easy to decide whether to use a simple long call option strategy or a long call spread in order to benefit from a given 3-month view on the underlying forward price.

Compared to buying the underlying spot outrights, the call option holder is able to gain leverage since the lower priced calls appreciate in value faster percentage-wise for every point rise in the price of the underlying spot.

However, call options have a limited lifespan. If the underlying spot price does not move above the strike price before the option expiration date, the call option would lapse worthless as the initial premiums paid to buy these call options would be the maximum losses.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate