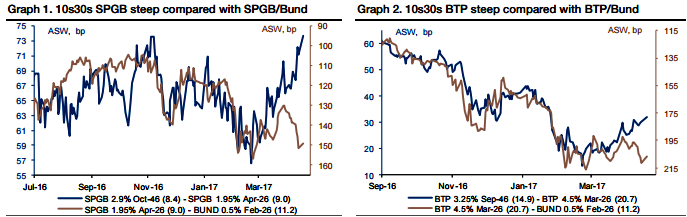

30y BTPs and Bonos have been weak lately. Typically, as peripheral spreads widen, the 10s30s in peripherals flattens. This is because selling pressures are often initially concentrated in the 10y, which is more liquid (IKA in Italy), and as spreads widen, there is less chance of 30y issuance. But over last week, we saw wider peripheral spreads to Bunds, and also steeper peripheral 10s30s (see Graphs 1 and 2). Our traders noted weak investor demand, though flows were small. Issuance has been light, too, reflecting the lack of demand. And dealers noted little overbidding at the latest BTP 20y auction.

Put on 10s30s SPGB flatteners, Long the SPGB Oct-2046 versus the Apr-2026 @ 73bp in ASW. Target 65bp; stops 79bp.

RV, hedge against worst-case scenario Political risk fading after the French elections (our central scenario) should help some convergence in Graph 1. 10s30s flatteners are also a hedge against a ‘political accident’.

Further curve steepening: Further curve steepening is a risk to the trade.

We have no doubt that issuers would like to sell more 30s. In Italy, for instance, expectations of a new 30y benchmark have been mounting of late, which looks consistent with the general appetite from treasuries for very long-dated issuance. And any rally after the French elections could prove tempting.

The risk of a new 30y BTP will maintain some pressure in Italy for the moment. It is interesting to note that Italy has issued as much this year as last at the long end, while Spain looks well in advance, having issued €9.3bn in 12y+ maturities versus just €7.4bn last year.

Very long supply is less of a risk in Spain, though Thursday’s auction could weigh a bit. In sum, 10s30s Bonos looks steep compared with the level of spreads, and there is the limited risk of large supply at the long end. The French election is the most obvious risk event now, and our central scenario looks for the victory of one of the market-friendly candidates.

And while a stabilization of political risk is a case for some convergence in Graph 1, a ‘political accident’ (debt redenomination, EU stability) would favor a sharp bear flattening in OATs, and in the periphery by contagion. 2026-2046 asset swap flatteners in Bonos offer interesting protection for cautious investors.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand