The euro was able to catch up significantly over the past few days (refer above chart). The dollar was unable to appreciate recently with the exception of the days of the lira crisis when it was in demand as a safe haven.

EURUSD has been consolidating around 1.1650 as we head into today’s key data. The underlying outlook is for a stronger correction towards 1.20-1.21, but a break of 1.1750-1.1850 is needed to open that move.

While under here, we risk a broader range developing, with 1.1525 - 1.1450 the ideal support region for a higher low. We are watching European equity markets closely as they return to year-long range supports.

Further out, the nature of the decline from the Spring 1.2500 highs suggests the correction of the rally from 1.0350 to there is ongoing and has the potential for a test down to 1.12-1.10 before a higher low develops to continue the long-term reversal from those 1.0350 2017 lows.

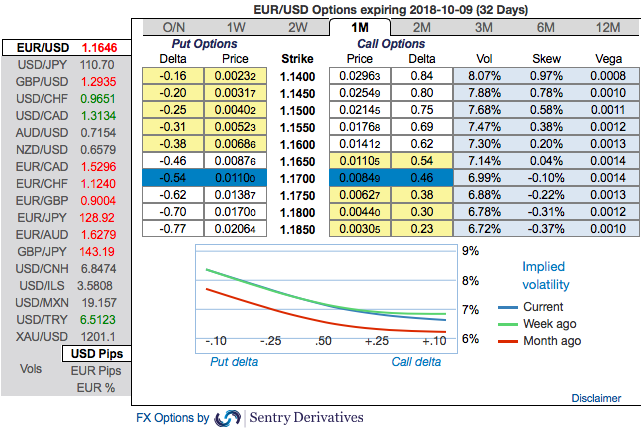

OTC Outlook: Please be noted that the positively skewed IVs of EURUSD of 1m tenors signify the hedging interest of bearish risks.

While RR numbers across all expiries show mild bullish shift in the short-term, whereas bearish risk sentiment remains intact in the long-run (refer long-term risk reversal numbers).

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1w at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside. Courtesy: Lloyds bank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 14 levels (which is neutral), while USD is flashing at -60 (which is bearish), while articulating at (08:24 GMT). For more details on the index, please refer below weblink:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?