- The Norwegian Krone plunged to a near 3-month low following Norges Bank's policy meeting outcome.

- Norway’s central bank kept its policy interest rate on hold at a record-low zero percent, as expected, and said any hike was still likely to be around two years away, in line with its June statement.

- Norway's central bank slashed rates three times since March, cutting the cost of borrowing from 1.5 percent to cushion the economy from the effects of the COVID-19 pandemic.

- The bid tone around the Norwegian currency further weakened after trade unions Safe, Industri Energi and Lederne said some 324 Norwegian offshore oil workers plan to go on strike from September 30 if annual pay negotiations with employers fail.

- Investors continued to digest yesterdays downbeat economic data, showing Norway's seasonally adjusted unemployment rate increased to 5.2 percent in the three months to August.

- Moreover, strength in the dollar index also weighed on the Norwegian Krone.

- The dollar index rallied to a 2-month peak as rising coronavirus infections in Europe and Britain undermined investor optimism about vaccine progress.

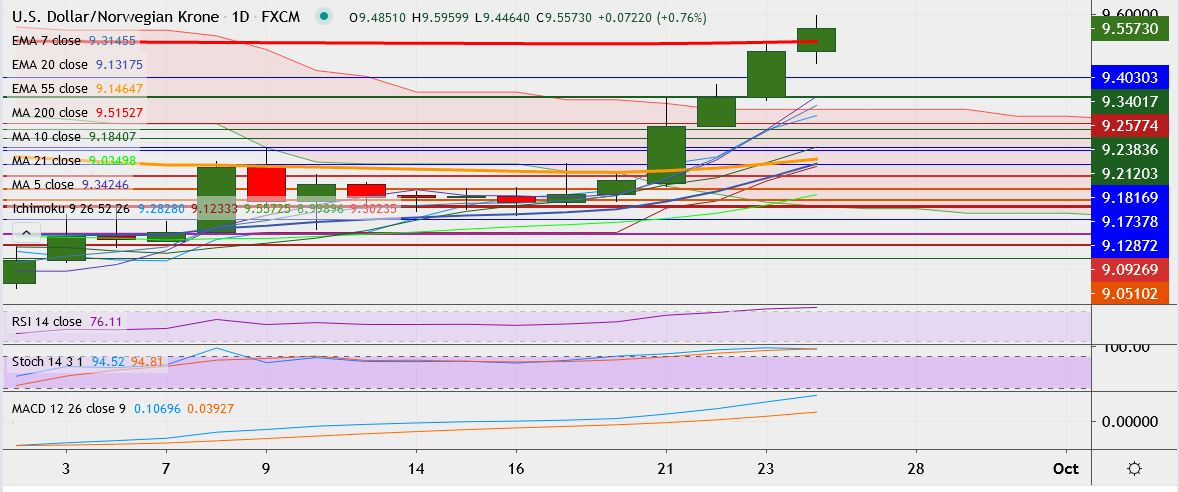

- USD/NOK trades 0.7 percent higher at 9.5490, having touched a high of 9.5959 earlier, its highest since July 1.

- On Wednesday, the pair rose as high as 9.5051 but found strong resistance at 200-DMA to close at 9.4851.

- Currently the pair trades above 200-DMA.

- Immediate resistance is located at 9.6335, close above could take it till 9.6711.

- On the downside, support is around 9.4241, break below could take it till 9.4071.

FxWirePro: Norwegian Krone near 3-month trough as Norges Bank holds rates at zero

Thursday, September 24, 2020 11:01 AM UTC

Editor's Picks

- Market Data

Most Popular