Major support - 20700

Nikkei trades slightly after a 2days of weakness. The overall trend for this week is to be flat until the G-20 meeting. According to Xinhua state-run Chinese news agency, Chinese President Xi Jiniping will attend the G-20 meeting in Japan this week. Oil rallied more than 9% previous week on Middle East tension The index hits intraday high of 21331 and is currently trading around 21306.

US Market- The Wall Street has closed slightly lower after hitting an all-time high with Dow Jones and S&P500 closed at 26719 (0.13%) and 2950 (0.13%) lower.

Japanese Yen- USDJPY is trading flat after more than 150 pips decline in the previous week. The pair hits a fresh 5- month low at 107.04 and a dip till 106. It is currently trading around 107.40.

Shanghai composite- Shanghai is trading steady after more than 4.5% jump in the previous week. Any convincing break above 3000 confirms minor trend reversal and a jump till 3050 is possible.

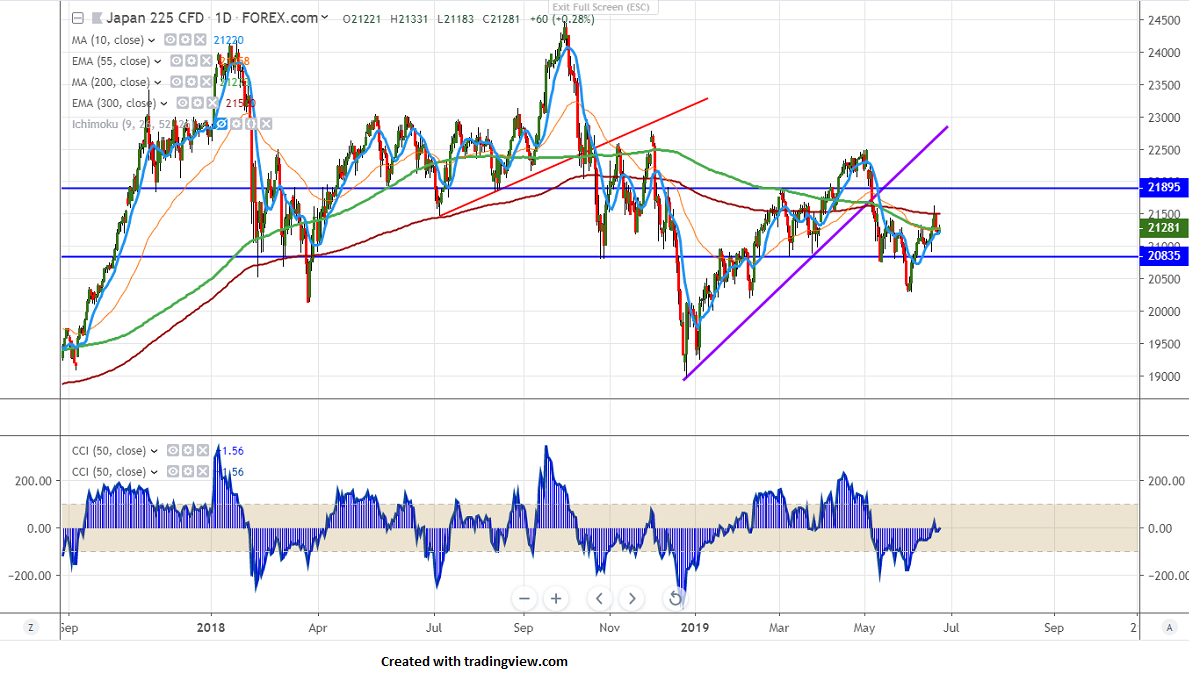

Technically Nikkei has halted its weakness near 10 day MA and shown a minor recovery. The near term resistance is around 21642 (61.8% fib) and any convincing break above targets 21800/22000 is possible.

On the flip side, near term support is around 21180 and any violation below this level will take the index till 21000/20700/20500/20291 (Jun 2nd low).

It is good to buy on dips around 21250 with SL 21000 for the TP 21800.