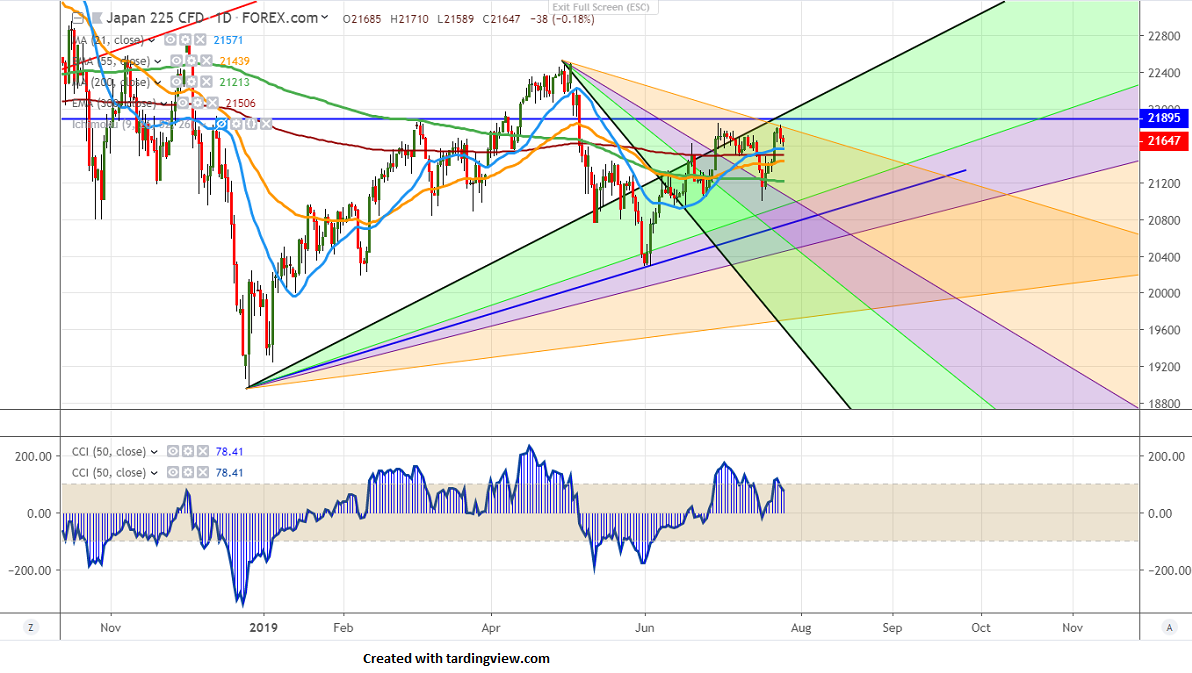

Major support - 20700

Nikkei has lost more than 200 points following the footsteps of Wall Street. The US markets fell from record high on mixed earnings. The Ford and Amazon results came slightly weaker than expected but Alphabet, Starbucks, and Intel have posted a strong set of earnings. ECB kept its rates unchanged and clearly stated that the central bank is willing to restart stimulus in the coming months. It hits a high of 21589 and is currently trading around 21647.

US Market- The Wall Street has closed marginally lower with Dow Jones and S&P500 at 27141 (0.47%) and 3003.9 (0.53%).

Japanese Yen- USDJPY jumped sharply more than 50 pips yesterday and any break above 109 confirms minor trend reversal. It is currently trading around 108.64.

Shanghai composite- Shanghai is trading higher for 4th consecutive days. Any major jump can be seen only above 2967. It is currently trading around 2939.

Technically Nikkei facing strong resistance around 21800 and any major jump can be seen only if it closes above this level. Any close above targets 22000/22280.

On the flip side, near term support is around 21500 and any violation below this level will take the index till 21315/21000.

It is good to buy on dips around 21500 with SL around 21300 for the TP of 22000.