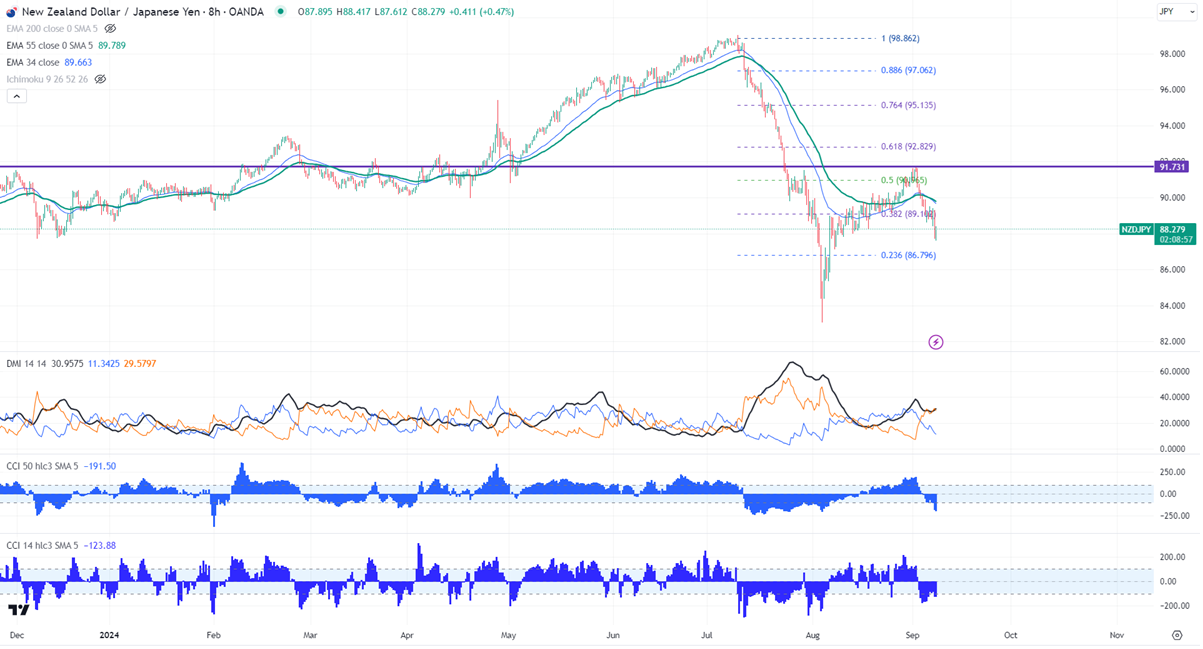

NZDJPY showed a minor pullback due to short covering. It hits a low of 87.61 at the time of writing and is currently trading around 88.26.

NZD formed a temporary top of around 91.66 from a multi-year low of 83.05. Overall bearish trend is intact as long as resistance 91.80-92 holds.

Technicals-

The pair trades below 34- and 55 EMA in the 8-hour chart.

The near-term resistance is around 88.60 (23.6% fib of 91.66 and 87.70), a breach above targets 89.15/89.84 (55- 8H EMA)/90.09. The immediate support is at 87.60, any violation below will drag the pair to 86.70/86.27/85.

Indicator (8-hour chart)

CCI (14)- Bearish

CCI (50)- Bearish

Average directional movement Index- Bearish. All indicators confirm a bearish trend.

It is good to sell on rallies around 88.62-65 with SL around 89.80 for a TP of 86.30.