Ever since the pair has rejected from the resistance of 0.7327 levels, Kiwi dollar has been losing its strength but taken support at 0.6950 on the flip side.

But, after dropping from major resistance at 0.7327 levels indicates previous consolidation trend seems again little weaker at this juncture.

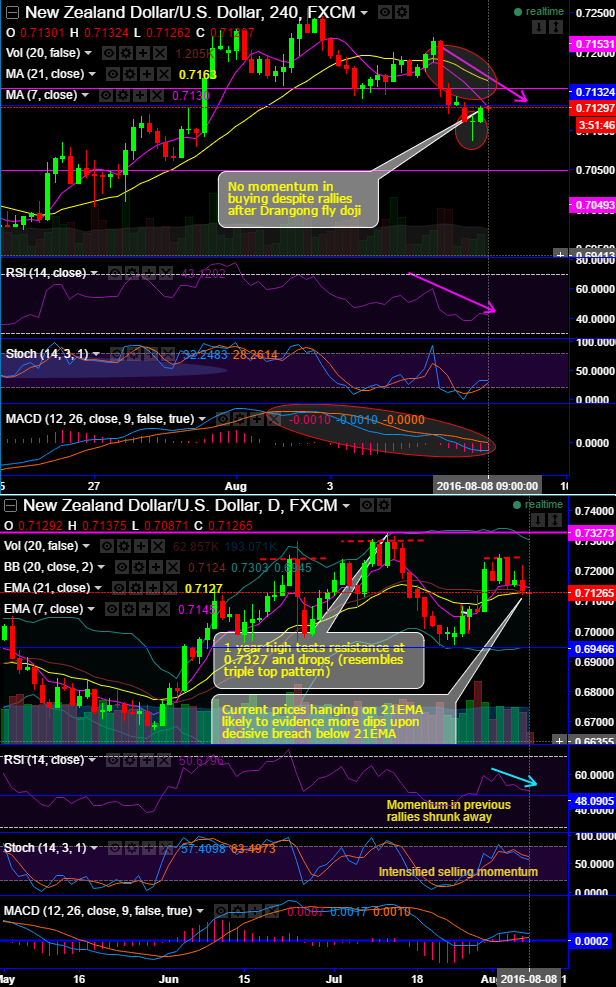

For now, more potential for downside targets are foreseen as current prices have dropped below 7DMA on daily charts (the decisive breach and sustenance below is closely watched).

Currently, prices hanging around 7EMA daily graph. Well, you can also observe 7DMA crosses below 21DMA on intraday charts (see 4H charts). No momentum in buying despite rallies after Dragon fly doji.

If it doesn't hold support at 7EMA, dips up to 50 pips on intraday basis and retest of 0.6950 is also possible ahead of RBNZ’s OCR cut expectations which seem more likely in monetary policy scheduled on Wednesday.

RSI and Stochastic oscillators on both daily and 4H’ly graphs are suggestive of further declines as they evidence downward convergence to the price dips.

%D crossover on daily plotting has been convincing that the selling momentum is still strong.

While intraday MACD is attempting to enter into the bearish trajectory which means bears are more likely to drag price slumps.

However, at this point in time advice is not to gear up with longs in puts as let OTC functions to intensify so that IVs would spike and by that time the above-stated technicals may signal more confirmations.

Meanwhile, considering above technical reasoning, on speculative grounds one can eye on option tunnel which is the debit spread of binary version.

In-The-Money tunnel would be formed of shorts of in-the-money binary put with shorter expiries below the current exchange rate less an Out-Of-The-Money longs binary delta put below the exchange rate.

We wouldn't be surprised if the spot FX drifts up to 30-40 pips below current levels of 0.7127 levels in no time.