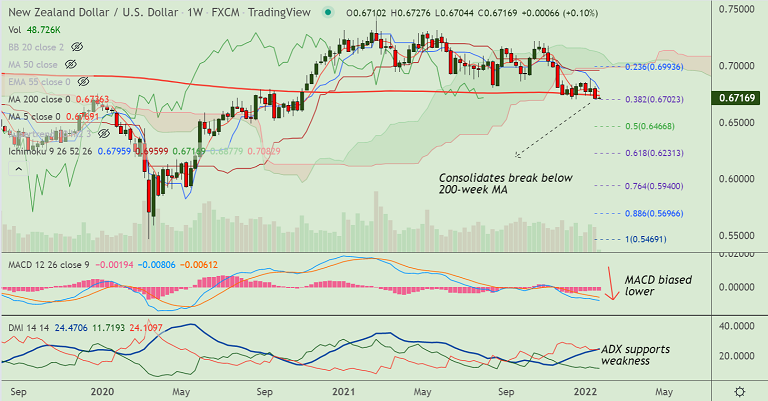

Chart - Courtesy Trading View

NZD/USD was trading 0.05% lower on the day at 0.6706, edges lower from session highs at 0.6727.

Price action closed below 200-week MA in the previous week, opening further downside in the pair.

Focus on Q4 Consumer Price Inflation data which will be released out of New Zealand on Thursday this week.

The Fed will decide policy on Wednesday and is widely expected to tighten monetary policy at a faster pace than expected to curb the continuously high inflation.

A hotter than expected NZ inflation outturn could result in a strengthening of the market’s conviction that the RBNZ is set to continue the rate hiking cycle.

This could place the RBNZ well ahead of the Fed regarding the removal of monetary accommodation.

Technical indicators are however biased lower. Momentum is strongly bearish and volatility is high.

Price action hovers around 38.2% Fib, scope for test of major trendline support at 0.6665. Bearish invalidation likely on retrace above 200-week MA.