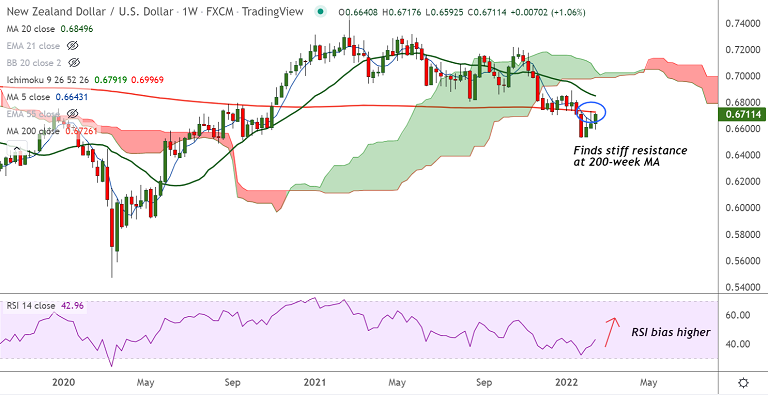

Chart - Courtesy Trading View

NZD/USD was trading 0.62% higher on the day at 0.6726 at around 08:50 GMT, outlook bullish.

The pair is on a bullish streak for the third consecutive week, tests 200-week MA resistance at 0.6726.

Technical indicators are bullishly aligned and decisive break above 200-week MA will propel the pair higher.

Sentiment improves across markets amid easing fears over an imminent Russian invasion of Ukraine.

Cautious optimism prevails as investors cheer the news of a meeting hosted by US President Joe Biden with international leaders on the potential Russian invasion of Ukraine.

On the data front, US Initial Jobless Claims, published by the Department of Labor came in at 248k, well above the market estimates and previous print of 219k and 225k respectively.

Hawkish Fed speak continues to boost dollar and may limit upside in the pair.

Support levels - 0.6673 (21-EMA), 0.6643 (20-DMA)

Resistance levels - 0.6726 (200-week MA), 0.6741 (55-EMA)

Summary: NZD/USD trades with a bullish technical bias. Watch out for breakout at 200-week MA resistance for upside continuation.