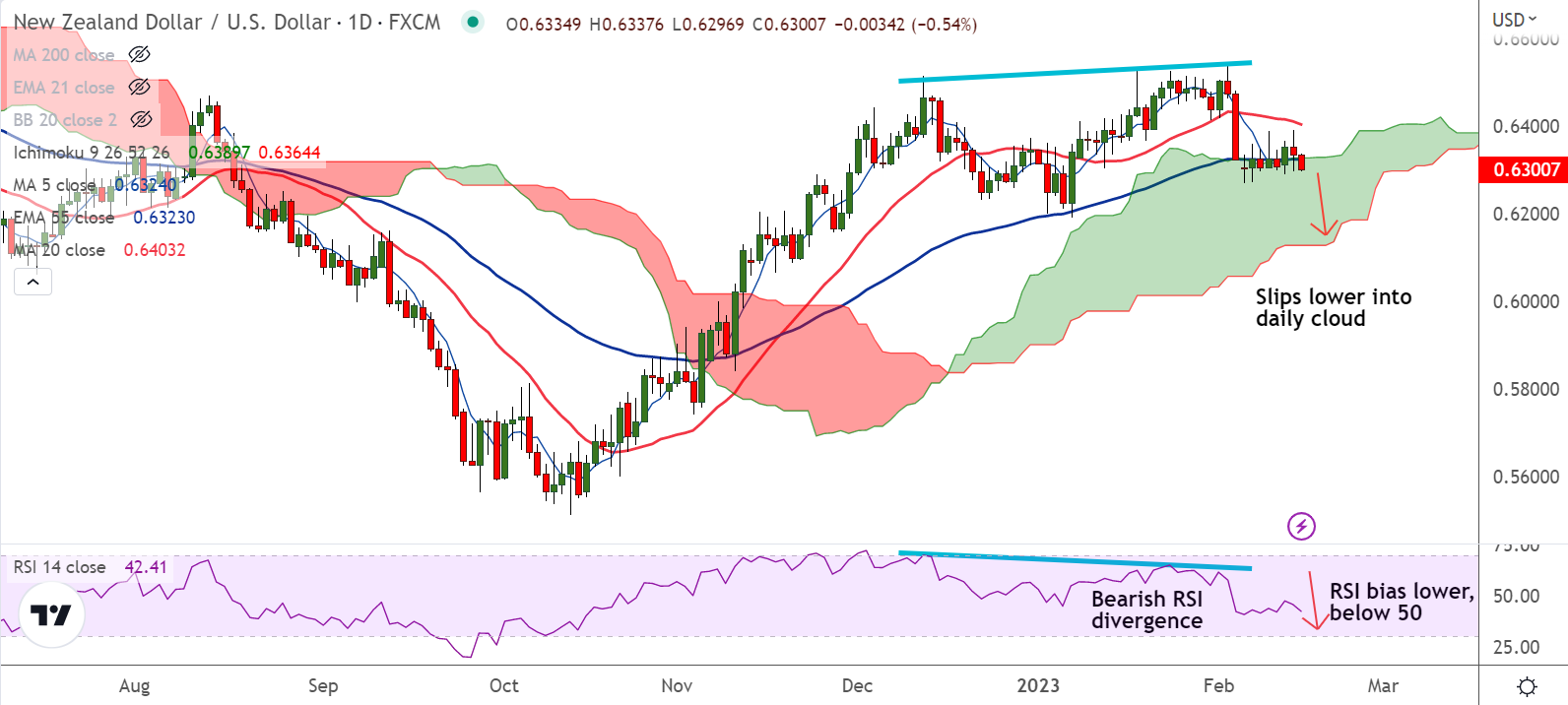

Chart - Courtesy Trading View

NZD/USD was trading 0.60% lower on the day at 0.6296 at around 06:30 GMT, bias remains bearish.

Risk-off market sentiment previals after stronger-than-expected US CPI report bolstered expectations the Federal Reserve will need to keep pushing interest rates higher to bring down inflation.

Domestically, the latest survey from the Reserve Bank of New Zealand (RBNZ) showed inflation expectations for two years ahead had eased to 3.3% from 3.6%, closer to its target band of 1%-3%.

New Zealand's annual inflation rose to a near 3-decade high of 7.2% in the December quarter but below the central bank's 7.5% projection.

New Zealand's unemployment rate also edged up to 3.4% in Q4 2022 from 3.3% in the previous quarter, stoking expectations of a less aggressive stance by the central bank.

Markets now expect the RBNZ to downshift to a 50 basis point rate hike in February after delivering a record 75 basis point increase in November.

NZD/USD is extending weakness for the 2nd consecutive session, slips further into the daily cloud.

Momentum is bearish, Stochs and RSI are biased lower, RSI is below the 50 mark. Bearish RSI divergence keeps scope for further downside.

Support levels - 0.6259 (110-EMA), 0.6185 (200-DMA)

Resistance levels - 0.6336 (200H MA), 0.6366 (21-EMA)

Summary: NZD/USD poised for more downside. Close below cloud top will confirm further weakness in the pair.