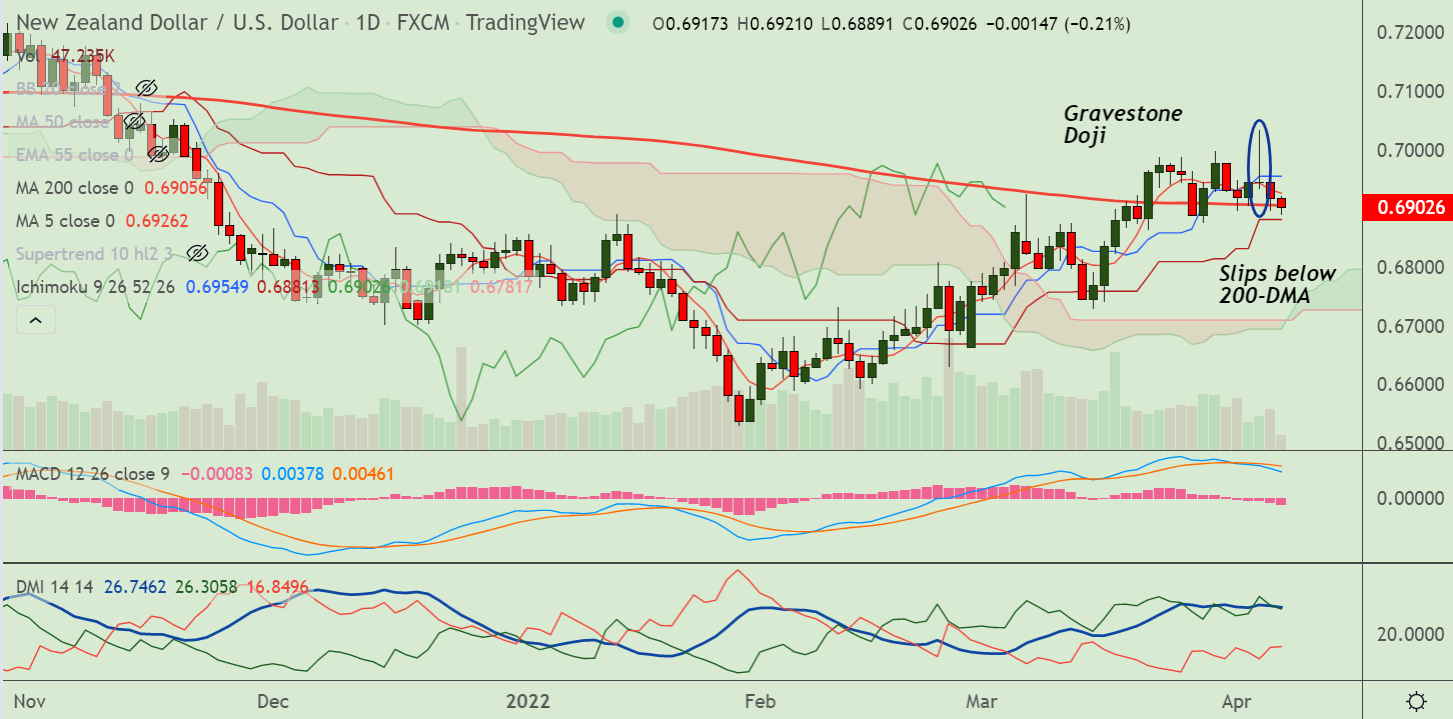

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- NZD/USD was trading 0.23% lower on the day at 0.6901 at around 10:20 GMT

- Price action is extending weakness for the 2nd consecutive session

- Gravestone Doji formation on Tuesday's candle dents upside in the pair

- MACD confirms bearish crossover on signal line, RSI is now biased lower

- Price action has slipped below 200H MA and is on verge of break below 200-DMA

- Stochs show bearish rollover from overbought levels and Chikou span is biased lower

Support levels - 0.6844 (110-EMA), 0.6837 (55-EMA), 0.6783 (50-DMA)

Resistance levels - 0.6905 (200-DMA), 0.6925 (5-DMA), 0.6955 (61.8% Fib)

Summary: NZD/USD pivotal at 200-DMA, decisive break below will add downside pressure. Retrace till 0.6780 likely.