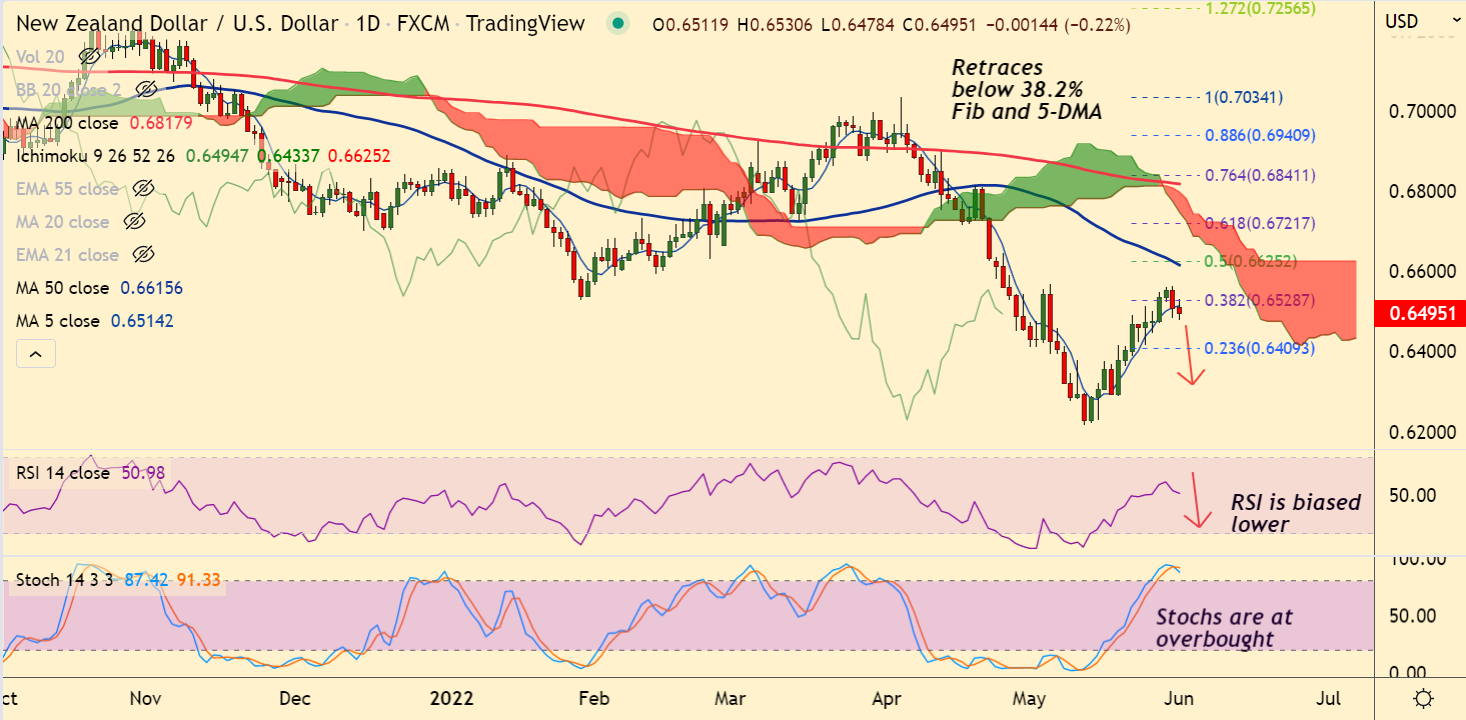

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.27% lower on the day at 0.6491 at around 06:35 GMT

Previous Week's High/ Low: 0.6549/ 0.6389

Previous Session's High/ Low: 0.6563/ 0.6482

Fundamental Overview:

Rising chances of an extreme hawkish stance by the Federal Reserve in its June monetary policy has strengthened the DXY.

Focus will remain on the US Nonfarm Payrolls (NFP) data, which is due on Friday. Analysts expect an addition of 320k jobs in April against 428k jobs recorded for March.

The antipodean has brushed aside upbeat China Caxin PMI data. IHS Markit has reported Caixin Manufacturing PMI at 48.1, higher than the forecasts and the prior print of 47 and 46 respectively.

Technical Analysis:

- NZD/USD is extending weakness for the 2nd straight session

- Price action has retraced 38.2% Fib and has slipped below 5-DMA

- RSI has turned lower and Stochs are on verge of bearish rollover from overbought levels

- The pair trades below daily cloud and Chikou span is biased lower

Major Support and Resistance Levels:

Support - 0.6468 (21-EMA), Resistance - 0.6568 (55-EMA)

Summary: NZD/USD was trading with a bearish bias. Major trend is bearish and recovery seems to be capped below 55-EMA. Scope for test of 21-EMA support, break below will see dip till 0.6398.