In this write-up, we emphasize on the disparity between the NZD IV skews and the long-term underlying projections. Well, please be noted that 1w IV skews of NZDUSD have been stretched on either side (refer above nutshell, it signifies both upside and downside risks ahead of RBNZ’s monetary policy meeting for its OCR, which is scheduled on November 7th), both OTM call and OTM put strikes have equal chances of expiring in-the-money.

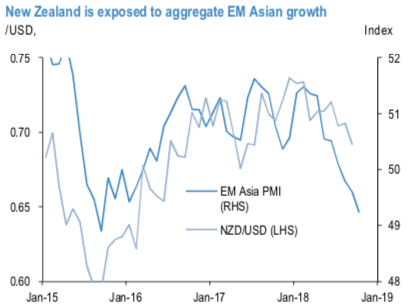

Whereas Kiwis dollar’s (NZD) weakness has been prolonged in sympathy with high-beta FX. This led us to slightly lower our NZD forecasts last month to reflect risk of ongoing negative news-flow relating to EM. In contrast to Australia, where the export-relevant commodity markets are already tight, New Zealand is unlikely to benefit from a redistribution of China’s GDP growth toward fixed asset investment. Rather, its mostly agricultural export basket is more exposed to softer EM Asian growth in aggregate (refer 1stchart).

The projections for NZD to end 3Q’19 at 0.61. There have also been important domestic drivers of NZD’s slide this year. The RBNZ has maintained dovish rhetoric, despite the fact that the 2Q GDP data came in better than expected. Looking at annual rates, GDP growth clearly has slowed, relative to the bullish rates that prevailed at the immigration peak over 2014-16. This is significant given that even over that extremely strong window for growth, the central bank struggled to lift inflation (refer 2ndchart).

RBNZ Governor Orr has highlighted that the OCR will need to be on hold until 2020, in order to push growth back above 3%. As with AUD, we expect ongoing confirmation that the central bank can credibly lag policy normalization in the G3, which should see the currency sustain recent devaluation even if EM outflows stabilize.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 113 levels (which is bullish), hourly USD spot index was at 10 (neutral), while articulating (at 13:22 GMT). For more details on the index, please refer below weblink:

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom