NZDUSD medium term perspectives: The month ahead could see NZDUSD extending beyond 0.7500 (Sep high) if the US dollar continues to register disappointment in the Trump Administration’s policies. Further ahead, though, the Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD lower to 0.7000. Granted, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend.

NZDUSD long-term perspectives: Slide up to 0.68 levels cannot be disregarded. The US dollar has had a remarkable bounce since the US polls and has potential to rise further in the months to come. The Fed’s assertive tightening projections plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar. Against that, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend.

We expect NZD to fall through this year, reaching 0.62 at year-end. The support to growth from migration will fade, while the RBNZ at the least are likely to hold rates steady as inflation normalizes, pushing real rates materially lower we think.

The economy is also now subject to credit tightening through numerous channels: macro-prudential constraints, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses. This creates the space or the need for the OCR to fall and drag NZD with it, while preserving monetary conditions.

OTC outlook and hedging framework:

Although the Kiwi dollar surged a bit in the recent times but sensing more bearish pressures in the upcoming future especially after data showed that China’s imports dropped far more than expected last month and although short-term dollar stress is seen FX markets, the greenback remained supported by Hawkish US central bank’s tone.

The FOMC remained on hold, as expected, at 0.50%-0.75%. There was little fresh news in the statement - risks are still seen "roughly balanced", activity is expected to expand at a "moderate pace" and that warrants "only gradual increases" in rates. The Fed conceded that the sentiment surveys have firmed: "Measures of consumer and business sentiment have improved of late" and their confidence on inflation has firmed a touch, the Fed noting: "inflation will rise to 2 pct" (vs "Inflation is expected to rise to 2 pct" previously). Otherwise, current conditions are largely unchanged, job gains are still considered "solid" and activity is growing at a "moderate pace". There are no strong clues here that the Fed is agitating to hike in March.

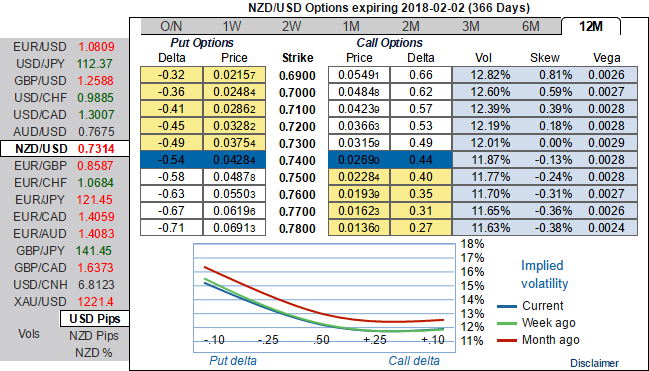

You could notice OTC market discounting these factors in 1y IV skews (they bid for OTM put strikes).

Well, to mitigate the further bearish risks, at spot reference 0.7287 we reckon the NZDUSD options strips with narrowed strikes.

Hence, we advocate to initiate longs in 2 lots of 1y -0.49 delta put options, while buying 1 lot of +0.51 delta calls of similar expiry.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data