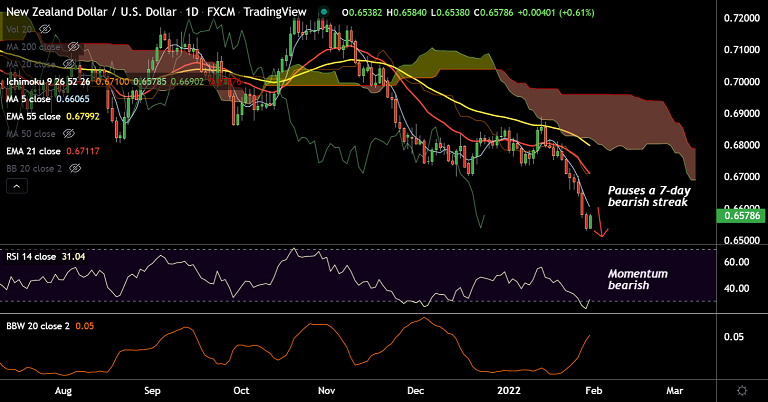

Chart - Courtesy Trading View

NZD/USD was trading 0.62% higher on the day at 0.6578 at around 10:00 GMT.

The pair has paused a seven-day bearish streak, but outlook remains bearish.

Doubts over the pace of the Fed’s rate hike in March and the downbeat Q4 US Employment Cost Index (ECI) led to a softer USD, thus pushing the pair higher.

Omicron spread in New Zealand (NZ) and geopolitical concerns surrounding Russia-Ukraine keep bias lower.

The pair ignored upbeat NZ Q4 Consumer Price Index (CPI). Focus now on this week’s employment data from the US and New Zealand for further impetus.

Technical bias for the pair remains bearish. Price action is consolidating break below 200-week MA.

Momentum is bearish and volatility is high. Scope for test of 50% Fib at 0.6466. Bearish invalidation only above 21-EMA at 0.6711.