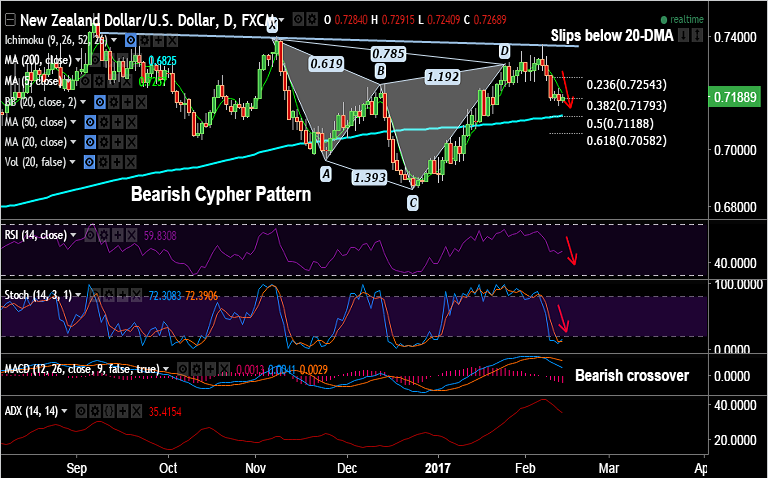

- NZD/USD is extending consolidation phase after break below 20-DMA at 0.7237 on Feb 9th.

- The pair is extending downside in continuation of the 'Bearish Cypher Pattern'.

- Technical indicators are biased lower, bearish invalidation only above 20-DMA at 0.7244.

- We see scope for test of 200-DMA at 0.7121. Violation there could see test of 61.8% Fib at 0.7058.

Support levels - 0.7155 (Feb 13 low), 0.7121 (200-DMA), 0.7058 (61.8% Fib)

Resistance levels - 0.7204 (5-DMA), 0.7244 (20-DMA), 0.7254 (23.6% Fib)

TIME TREND INDEX OB/OS INDEX

1H Bullish Neutral

4H Bearish Neutral

1D Bearish Neutral

1W Neutral Neutral

Recommendation: Good to go short on rallies around 0.7203, SL: 0.7250, TP: 0.7135/ 0.7120/ 0.71/ 0.7060

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -51.3869 (Bearish), while Hourly USD Spot Index was at -18.78 (Neutral) at 0640 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.