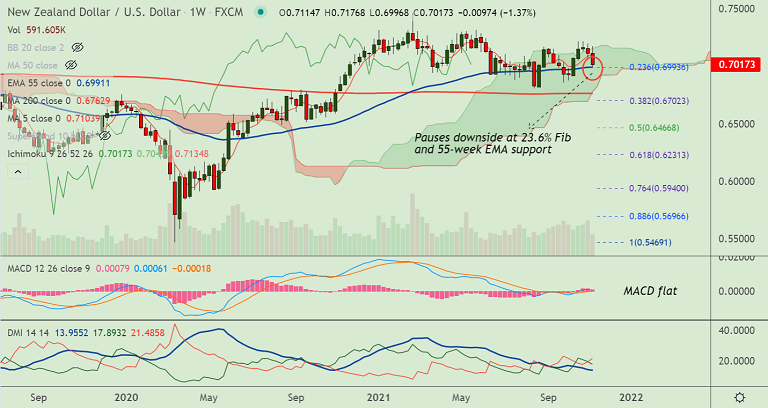

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading largely unchanged at 0.7021 at around 09:15 GMT

Session High/ Low: 0.7033/ 0.6996

Previous Week's High/ Low: 0.7197/ 0.7072

Previous Session's High/ Low: 0.7071/ 0.7012

Fundamental Overview:

U.S. inflation data released on Wednesday showed that the US CPI grew 6.2% y/y and 0.9% m/m in October, while the core CPI rose 4.6% y/y and 0.6% m/m.

Investors raise Fed rate hike bets, are now pricing the first rate hike by July 2022 and another by December of that year, according to Reuters data.

Focus now on inflation readings from a University of Michigan survey, along with JOLTS job openings data later in the day for further impetus.

New York Fed President John Williams is scheduled to speak at an online conference, which could provide clues to the Fed’s reaction to high inflation.

Technical Analysis:

- NZD/USD extends weakness below 200-DMA

- Momentum is strongly bearish, Stochs and RSI are strongly lower

- Price action is below major moving averages which are trendline lower

- Volatility is high and rising as evidenced by widening Bollinger bands

Major Support and Resistance Levels:

Support - 0.6987 (daily cloud), 0.6960 (23.6% Fib), 0.6930 (trendline)

Resistance - 0.7057 (38.2% Fib), 0.7076 (5-DMA), 0.7093 (200-DMA)

Summary: NZD/USD holds above daily cloud, technical bias is bearish. Breach below cloud will see dip till 0.6930.