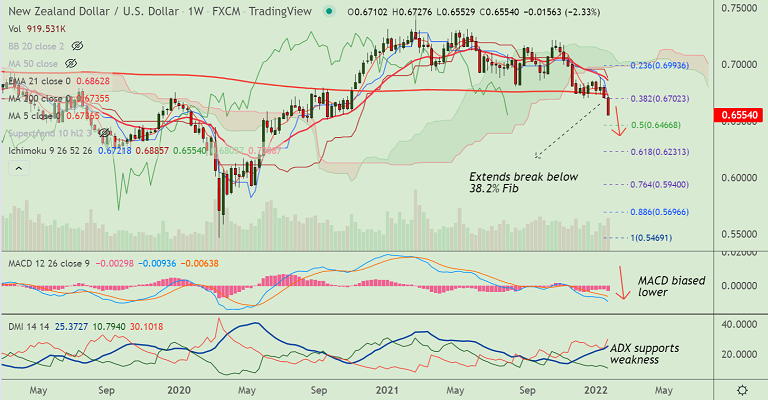

Chart - Courtesy Trading View

NZD/USD was trading 0.43% lower on the day at 0.6555 at around 10:00 GMT, outlook bearish.

The pair extends bearish streak for the 7th straight session, hits fresh 15-month lows below 0.66 handle.

The Federal Reserve confirmed a rate hike coming in March, fueling speculation of at least four hikes this year.

The greenback got additional support from upbeat data overnight, with Q4 GDP at 6.9%, beating expectations at 5.5%.

Meanwhile, unemployment claims in the week ended January 14 met expectations by printing at 260K.

Focus now on the Fed’s preferred version of inflation - Core PCE Price Index figures for December. Markets expect a 4.8% YoY figure versus 4.7% prior.

Technical indicators for the pair are strongly bearish. The major is extending previous week's close below 200-week MA.

Bears are on track to test 50% Fib retracement at 0.6466. Bearish invalidation only above 200-DMA.