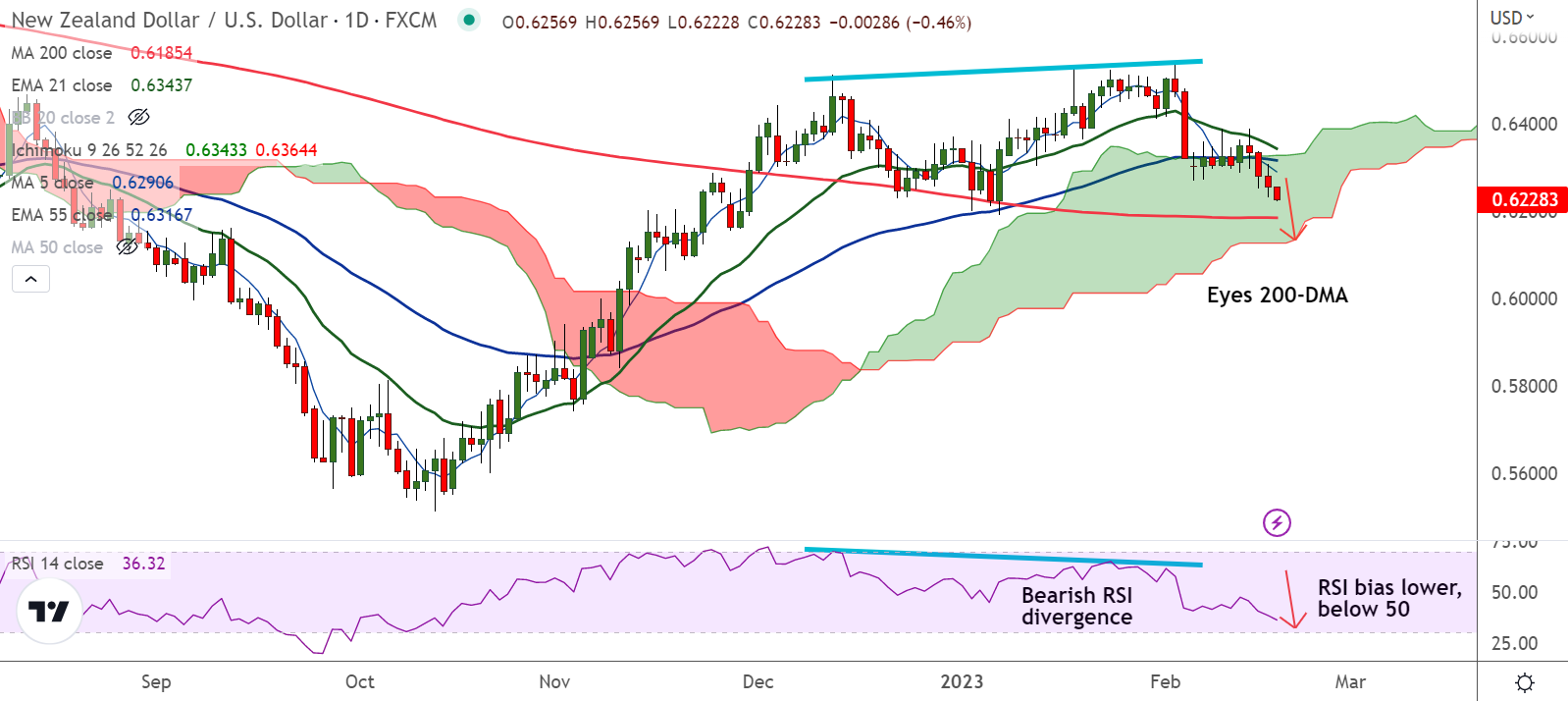

Chart - Courtesy Trading View

NZD/USD was trading 0.47% lower on the day at 0.6227 at around 03:50 GMT, extends weakness for the 4th straight session.

The U.S. dollar firmed across the board on Thursday, bolstered by stronger-than-expected producer prices and falling jobless claims data.

Data released overnight showed US Producer Price Index (PPI) for January was up 0.7% MoM after declining 0.2% in December.

Meanwhile, US Initial Jobless Claims for the week ended February 10th, unexpectedly fell to 194,000, compared to the 200,000 expected and 195,000 prior.

Upbeat figures hinted that the Federal Reserve would have to maintain its inflation-fighting interest rate hikes for longer.

Interest rate futures market now shows US rates could peak close to 5.25% by July before dropping to 5.0% by the end of the year.

The U.S. dollar continued to benefit from rising rate expectations, weighing on the commodity currencies.

On the other side, after the devastating impact of Cyclone Gabrielle, the Reserve Bank of New Zealand (RBNZ) is expected to pause at next week's policy meeting.

Major Support Levels:

S1: 0.6185 (200-DMA)

S2: 0.6127 (Cloud base)

Major Resistance Levels:

R1: 0.6290 (5-DMA)

R2: 0.6343 (21-EMA)

Summary: NZD/USD was trading with a bearish bias. The pair is on track to test 200-DMA at 0.6185. Further weakness only on decisive break below.