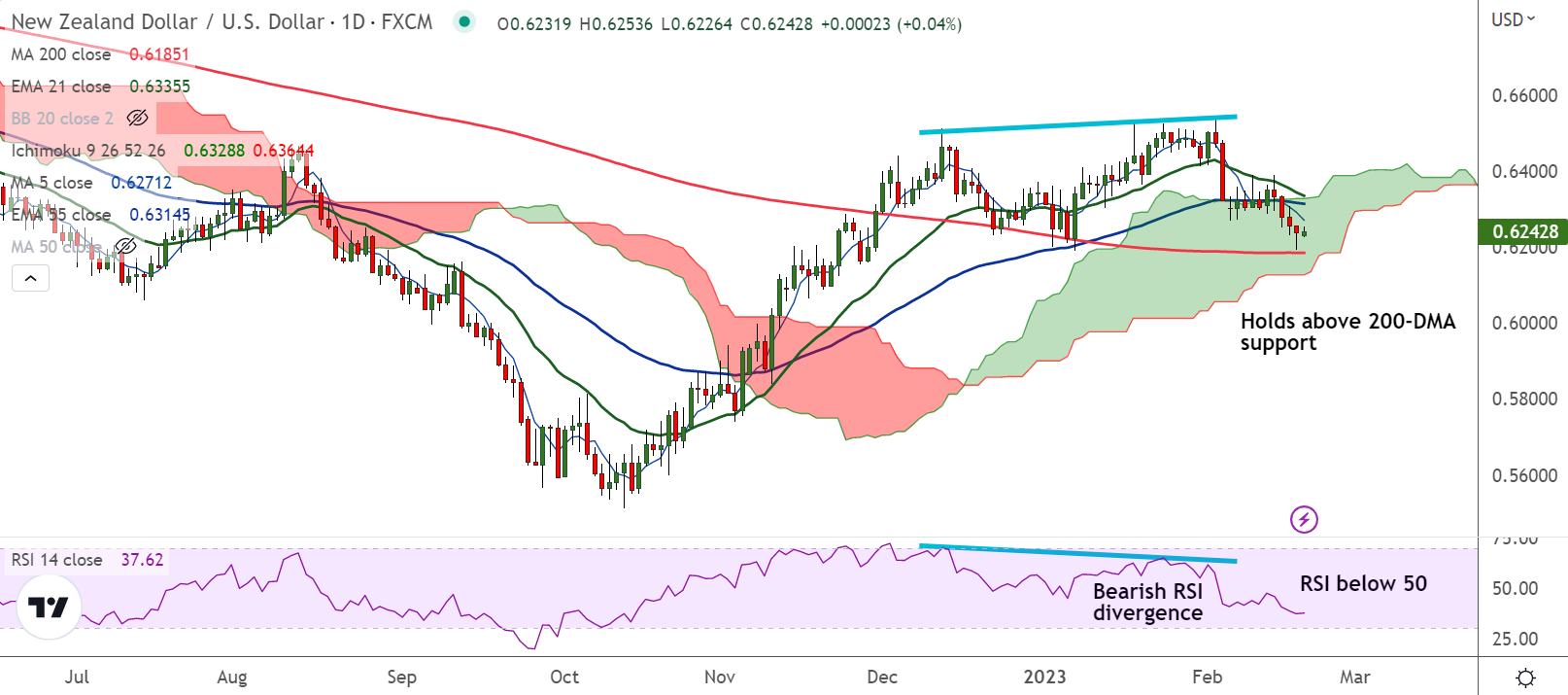

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.04% higher on the day at 0.6242 at around 04:57 GMT.

Previous Week's High/ Low: 0.6256/ 0.6193

Previous Session's High/ Low: 0.6389/ 0.6193

Fundamental Overview:

The antipodeans buoyed by China stimulus hopes. The People’s Bank of China (PBoC) held its key mortgage rates at historic lows for 6th month.

China's one-year loan prime rate (LPR) was kept at 3.65%, while the five-year LPR was unchanged at 4.30%.

Despite the recovering momentum, some analysts expect rates will ease after China's annual parliamentary gathering in March, when the government announces key growth targets for the year.

Risk aversion theme has lost its traction, investors ignore US-China tensions and North Korea’s missile attacks near Japan’s Exclusive Economic Zone (EEZ) region.

Focus now on the release of the Federal Open Market Committee (FOMC) minutes, which will release on Wednesday.

The market participants will keenly watch for the inflation projections and cues related to March’s monetary policy.

Technical Analysis:

- Momentum is bearish, Stochs and RSI are sharply lower

- Price action is below major moving averages

- The pair is holding marginal gains after Hammer formation on the previous session

- GMMA indicator shows major trend is neutral, while minor trend is bearish

Major Support and Resistance Levels:

Support - 0.6185 (200-DMA), Resistance - 0.6271 (5-DMA)

Summary: NZD/USD has paused 4-day bearish streak at 200-DMA support, further weakness only on break below. On the flip side, break out of daily cloud will see upside continuation.