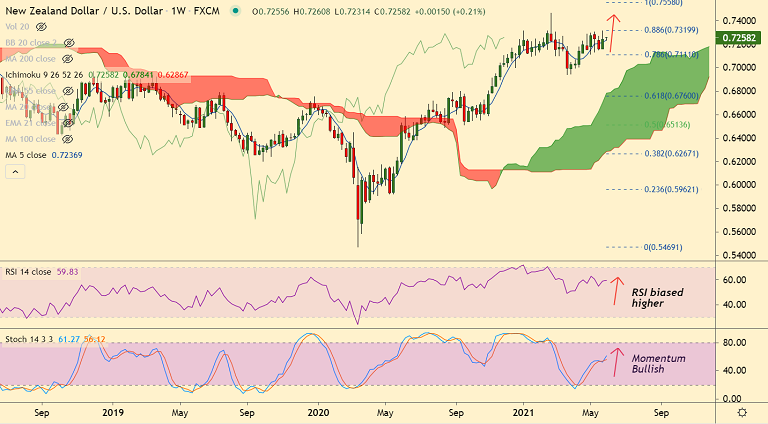

NZD/USD chart - Trading View

Spot Analysis:

NZD/USD was trading 0.21% higher on the day at 0.7258 at around 05:00 GMT.

Previous Week's High/ Low: 0.7316/ 0.7158

Fundamental Overview:

Trading remains muted amid mixed data and holiday-thinned trade with the U.S. remaining closed on account of Memorial Day.

On the data front, China NBS Manufacturing PMI eased below 51.1 forecast and prior to 51.1 in May.

Meanwhile, China Non-Manufacturing PMI printed at 55.2, marking a big beat on market consensus at 52.7 and 54.9 previous readouts.

Further, the Australia and New Zealand Banking Group’s (ANZ) Business Confidence and Activity Outlook for May dropped below 7 and 32.3% levels to 1.8 and 27.1% respectively.

Among the risk catalysts, New Zealand’s worries of escalating tussles with China along with Sino-American tussles test the market optimism.

That said, hopes of further stimulus from the US and the Fed’s ability to keep the easy money on keep downside limited.

Technical Analysis:

- Technical bias for the pair is bullish, scope for upside.

- GMMA indicator shows major and minor trend are bullish.

- Price action is above cloud and major moving averages.

- Oscillators are biased higher and volatility is high.

Major Support and Resistance Levels:

Support - 0.7220 (21-EMA), 0.7184 (55-EMA), 0.7125 (110-EMA)

Resistance - 0.73 (Psychological mark), 0.7310 (Upper BB), 0.7320 (88.6% Fib)

Summary: NZD/USD trades muted, but bias remains bullish. Scope for test of 88.6% Fib at 0.7320 ahead of yearly high at 0.7464. Bullish invalidation only below 200-DMA.