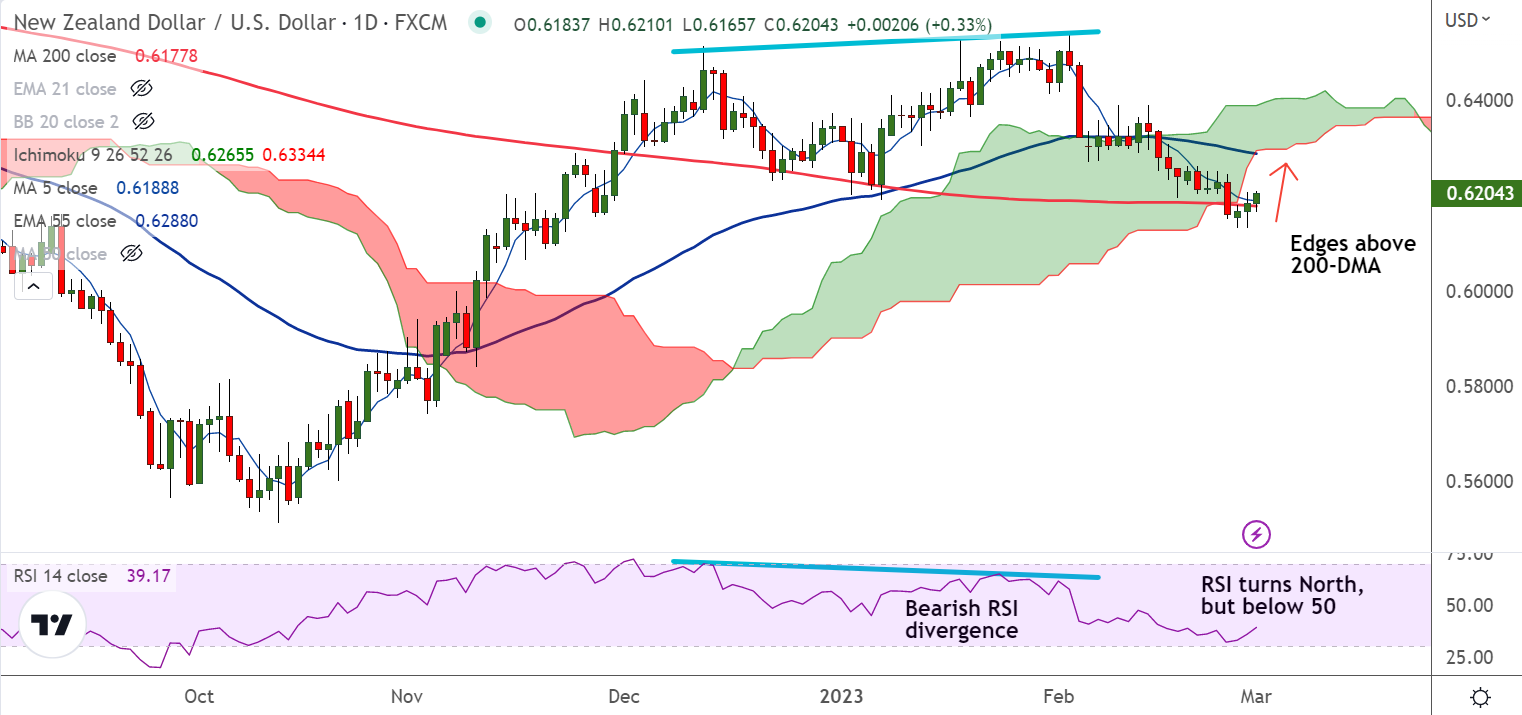

Chart - Courtesy Trading View

NZD/USD was trading 0.38% higher on the day at 0.6208 at around 04:35 GMT, breaks above 200-DMA resistance.

Higher-than-anticipated China Caixin Manufacturing PMI and broad-based US dollar weakness ahead of ISM Manufacturing PMI supports the pair higher.

Data released earlier on Tuesday showed China IHS Markit Caixin Manufacturing PMI printed at 51.6, higher than the expectations of 50.2 and the former release of 49.2.

Further, China’s National Bureau of Statistics (NBS) Manufacturing PMI (Feb) came in at 52.6 also beating consensus of 50.5 and the prior release of 50.1.

The Services Manufacturing PMI spiked to 56.3 against 54.4 released in January, beating forecasts for a downbeat figure at 49.7.

On the other side, US Dollar Index (DXY) remains under pressure, trades 0.07% lower on the day at 104.87 ahead of the release of US ISM Manufacturing PMI data.

US ISM Manufacturing PMI is seen at 48.0 from 47.4 prior. Further, the New Orders Index is expected to rebound to 43.7 from the prior figure of 42.5.

NZD/USD is extending gains for the 3rd consecutive session. Price action has edged above major resistance at 200-DMA and is currently testing 200H MA.

Back-to-back spinning tops at lows suggest downside exhaustion and oversold oscillators raise scope for upside resumption.

Major Support Levels:

S1: 0.6177 (200-DMA)

S2: 0.6125 (Lower BB)

Major Resistance Levels:

R1: 0.6210 (200H MA)

R2: 0.6251 (110-EMA)

Summary: Watch out for close above 200-DMA for upside continuation. Failure at 200H MA negates any further gains.