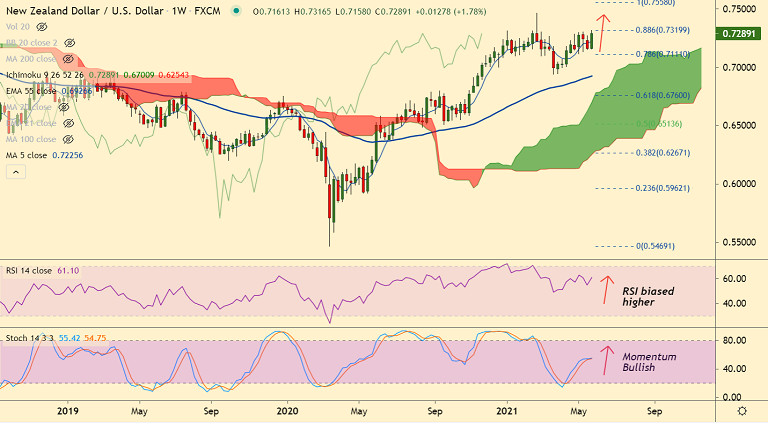

NZD/USD chart - Trading View

NZD/USD was trading 0.14% higher on the day at 0.7287, after closing 0.75% higher in the previous session.

The kiwi is set to extend RBNZ-led gains. The Reserve Bank of New Zealand left interest rate unchanged on Wednesday and signaled rate hikes from mid-2022.

The central bank re-introduced the conventional OCR forecast which showed a 150bps tightening between Q3 2022 and Q3 2024, taking markets by surprise.

RBNZ Gov Adrian Orr while speaking before parliament's Finance and Expenditure Committee earlier on Thursday reiterated possible rate hike by late 2022, citing optimism at home and abroad.

Support levels - 0.7267 (Trendline), 0.7232 (5-DMA), 0.7212 (21-EMA)

Resistance levels - 0.7320 (88.6% Fib), 0.74, 0.7468 (Upper monthly BB)

Summary: NZD/USD consolidates the RBNZ-led gains, technical bias has turned bullish. Bulls target next major resistance at 0.7435 ahead of 0.7558 (2017 high).