- Kiwi edges higher, NZD/USD 0.22% higher on the day at around 1230 GMT.

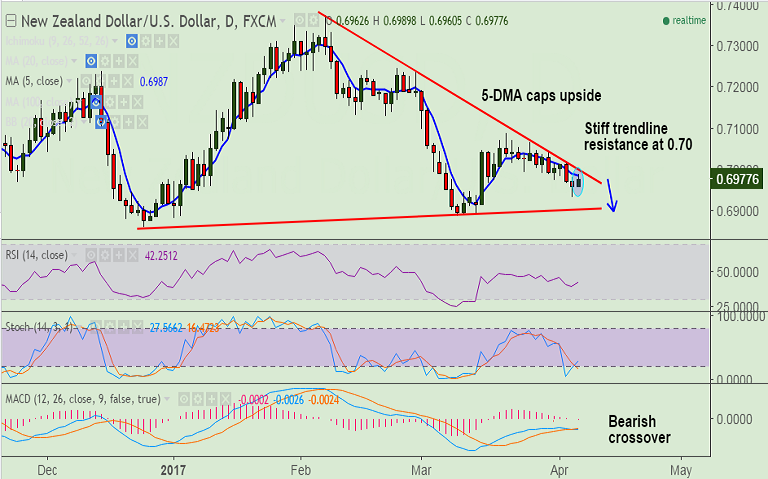

- Bias remains bearish as long as the pair holds major trendline resistance at 0.70 levels.

- Break above could see reversal of downside, test of 0.7090 (March 21 high)then likely.

- Fall in the NZ business morale in Q1 2017 to keep downbeat tone around the Kiwi.

- Technically, upside in the pair rejected at major resistance at 0.7015.

- The pair has closed below 20-DMA and edged below 0.6972 (78.6% Fib) affirming near-term downside bias.

- Next major support is seen at trendline at 0.69.

Support levels - 0.6920 (88.6% Fib), 0.69 (trendline), 0.6890 (Mar 9 low)

Resistance levels - 0.6997 (20-DMA), 0.6991 (5-DMA), 0.7015 (trendline)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-NZD-USD-capped-below-major-trendline-resistance-good-to-go-short-on-rallies-617244) has hit TP1.

Recommendation: Bias lower, stay short.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 115.514(Bullish), while Hourly USD Spot Index was at 65.1915 (Bullish) at 1230 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.