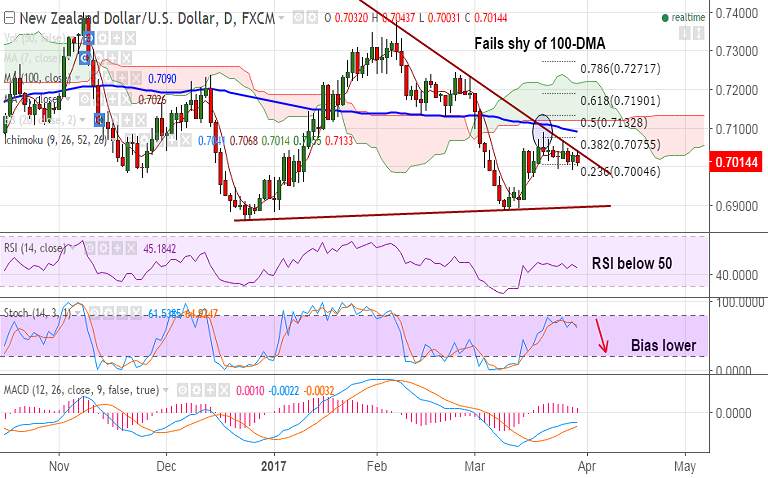

- NZD/USD hovers around 5-DMA, but remains capped below major trendline resistance at 0.70.

- A follow through greenback recovery, with DXY reclaiming the key 100.00 psychological mark, has been weighing on the major.

- NZD/USD trades with a bearish bias, scope for test of 0.6895 (trendline support).

- Price action is below daily cloud and major moving averages, technicals also bearish on intraday charts.

Support levels - 0.6972 (78.6% Fib retrace of 0.68621 to 0.73756 rally), 0.6920 (88.6% Fib), 0.6890 (Mar 9 low)

Resistance levels - 0.7026 (5-DMA), 0.7058 (61.8% Fib), 0.7093 (100-DMA)

TIME TREND INDEX OB/OS INDEX

1H Bearish Neutral

4H Bearish Neutral

1D Bearish Neutral

1W Neutral Neutral

Recommendation: Good to go short on rallies around 0.7025/35, SL: 0.7095, TP: 0.6970/ 0.6920/ 0.69

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -15.6905 (Neutral), while Hourly USD Spot Index was at 75.1094 (Bullish) at 0830 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.