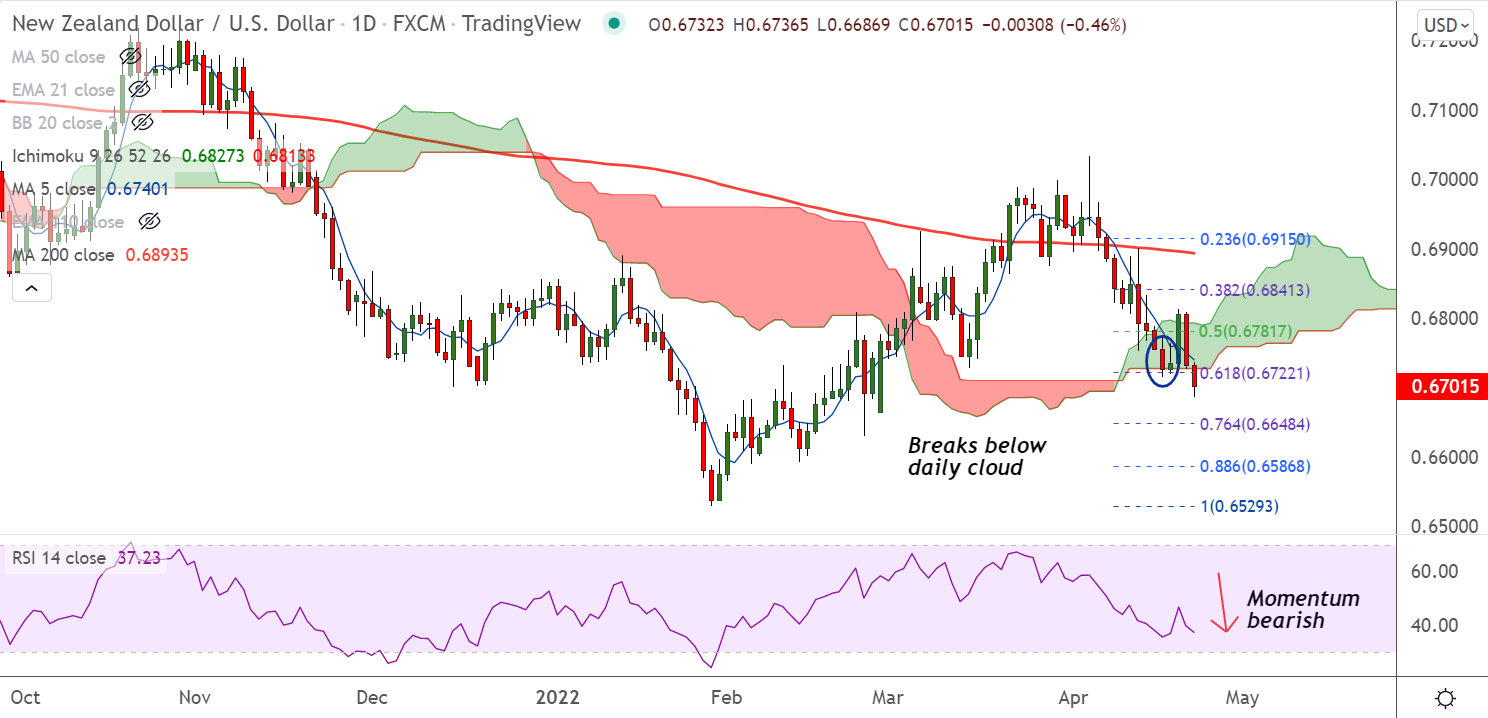

Chart - Courtesy Trading View

NZD/USD was trading 0.74% lower on the day at 0.6680 at around 06:50 GMT.

The major has shown a break below daily cloud, raising scope for further downside.

US dollar buoyed on hawkish Fed rhetoric, weighing on the pair, dragging it lower.

Federal Reserve chair Jerome Powell renewed fears of significant liquidity shrinkage from the economy, underpinned a 50 bps rate hike.

GMMA indicator shows minor trend is strongly bearish, while major trend is also turning bearish.

MACD and ADX support downside, Chikou span is biased lower. Momentum is bearish, volatility is high and rising.

Support levels:

S1: 0.6648 (76.4% Fib)

S2: 0.66

Resistance levels:

R1: 0.6736 (5-DMA)

R2: 0.6777 (200H MA)

Summary: NZD/USD trades with a strong bearish bias. Scope for test of 76.4% Fib at 0.6648.